Value Added Tax (VAT) is a consumption-based indirect tax levied on the value added to goods and services at each stage of the supply chain. It is constituted to be borne by the final consumers, making it consumption-based. VAT is a common form of indirect tax used by many countries.

VAT compliance can pose many challenges such as complex regulatory requirements, cross-border transactions, Invoicing and documentation, different regulatory requirements across different jurisdictions, refunds, and recovery complexion, changing regulations, technology adoption, data accuracy, etc.

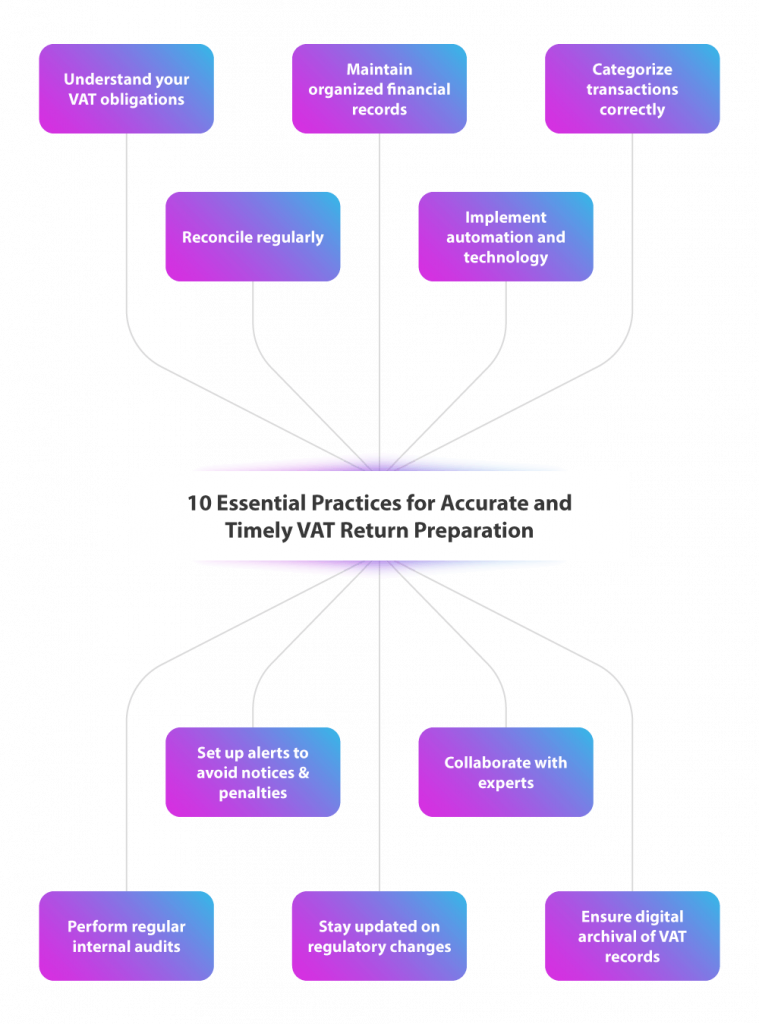

Businesses must follow best practices for VAT reporting to minimize the risk of errors, penalties, and reputational damage while ensuring smooth VAT compliance operations across different countries and jurisdictions.

This blog will help VAT returns to be prepared in a simplified way for businesses while maintaining accuracy and timeliness.

1. Understand Your VAT Obligations

It is important to understand the VAT obligation for businesses, especially with the increased international business, there has been a significant increase in the complexity of VAT compliance.

Each country has its own VAT rules and regulations regarding VAT registration, VAT return preparation, and other VAT compliance.

Further international businesses give rise to understanding and working in different languages, coping with exchange rate fluctuation, technology integration across the countries, and archival data at remote locations.

To address this challenge businesses, especially those operating internationally, must invest in specialized VAT compliance solutions, hire experts, and tax consultants, and establish effective processes for managing VAT obligations across various jurisdictions.

2. Maintain Organized Financial Records

Accurate VAT return preparation practice begins with regularly maintaining well-organized financial records.

Keeping detailed records of all transactions, invoices, receipts, and expenses can assist businesses in avoiding any errors or discrepancies.

Efficient VAT recordkeeping solutions can help businesses maintain transparency, accurate and timely VAT submissions, informed decision-making, multi-jurisdictional compliance, and internal control.

Therefore, it is inevitable for businesses to implement a reliable compliance system or solution to track VAT-related information efficiently and keep track of any out-of-the-blue changes.

This not only enables accurate reporting but also simplifies the auditing process, making the whole procedure easier for employees to keep up with and leads the organization to be future audit-ready.

3. Categorize Transactions Correctly

Properly categorizing transactions is another vital part of ensuring accurate VAT calculations. Transactions should be classified as either taxable, exempt, or zero-rated, making it clear for businesses to easily identify different transactions.

Misclassification can lead to incorrect calculations which can further result in potential non-compliance issues.

Regularly reviewing and updating their transaction categories to align with the latest regulations can assist firms in an easier return preparation procedure.

Compliance suits or systems can intelligently classify transactions based on set rules and business logic and can also improve based on historical data and user interactions.

4. Reconcile Regularly

Regular reconciliation of financial records with various sources of data such as invoices, receipts, and VAT returns helps in identifying any discrepancies and errors in VAT calculations, missing invoices or data, and duplicate entries.

It helps to confirm the VAT liability paid matches with actual transactions and that Input and output VAT are correctly aligned.

By regularly reconciling VAT records, the risk of non-compliance with rules and regulations due to inaccurate and incomplete data can be mitigated and any inaccuracy or error can be corrected promptly.

5. Implement Automation and Technology

Leveraging automation and technology can significantly streamline the VAT return filing process for enterprises around the world. Modern compliance system or solution can automate data extraction from invoice, integrate with companies’ accounting software or ERP to automate data entry and accounting, verification, and reconciliation of VAT records, provides accurate VAT calculations, and even generate VAT return reports.

Automation, moreover, reduces the risk of manual errors and saves businesses a load of time, allowing them to divert their workforce resources elsewhere and focus on other core business activities.

6. Set Up Alerts to Avoid Notices & Penalties

Timeliness is key when it comes to VAT return filing. Missing deadlines can result in penalties and fines, which can be extremely burdensome in certain cases.

Setting up alerts and reminders well in advance of the filing due dates, no matter how simple a strategy, can play a big role in timely filing as it enables businesses to ensure they have ample time to gather the necessary information and complete the return accurately.

7. Collaborate with Experts

If VAT regulations are complex or unfamiliar to firms, they should consider seeking professional advice from VAT experts and professionals.

These experts can provide valuable insights into local VAT laws, help optimize a firm’s VAT position, and ensure compliance with VAT regulations.

Investing in professional assistance can ultimately save businesses their money and a load of trouble in the long run.

8. Perform Regular Internal Audits

Conducting internal audits periodically to review VAT processes and identify any areas for improvement is a proactive approach that helps businesses identify potential errors or inefficiencies and allows them to implement corrective measures promptly, allowing firms to be on top of their VAT return preparation and filing game.

9. Stay Updated on Regulatory Changes

VAT regulations are subject to change. Staying up to date with regulatory and technical changes among different countries is crucial for navigating the complexity of international VAT compliance.

Businesses should consider subscribing to relevant tax authorities’ newsletters, attending respective seminars, or engaging with industry associations to stay up to date with the latest VAT developments and keep up with any modifications.

Adapting to and keeping up with regulatory changes in a timely manner prevents non-compliance and ensures accurate reporting without any last-minute hassle.

10. Ensure digital archival of VAT records

Digital archival of VAT records helps in fulfilling legal requirements with minimum storage cost as many jurisdictions mandate businesses to retain VAT-related records for several years.

It can serve as an audit trail to tax authorities for review and can be provided or shared easily as evidence or support in case of any dispute or inquiries related to VAT.

When the data is archived digitally, it helps in maintaining data security and data integrity and can be accessed or retrieved quickly and remotely by an authorized person.

Conclusion

VAT return filing can be a complex task, especially for some businesses that lack the proper knowledge of this concept. But with correct VAT compliance strategies, meeting tax deadlines and VAT regulations is possible. By understanding their obligations, maintaining accurate records, leveraging technology, and staying informed about regulatory changes, businesses can simplify the process while ensuring accurate and timely preparation and filing of VAT returns. Accuracy and compliance not only prevent financial penalties but also contribute to the overall financial health and reputation of your business, thus becoming a vital aspect of a business’s operations.