In the previous article, “Transaction with Buyers: Understanding Malaysia’s e-invoicing Compliance” we learned about transactions with buyers, mainly end customers or with specific businesses in which an e-invoice is not compulsory unless requested by the buyer, and the supplier can issue consolidated e-invoices as proof of expense.

There are certain transactions in which consolidated e-invoices cannot be issued; only regular e-invoices shall be issued. This would also require the buyer to provide their details for the issuance of an e-invoice.

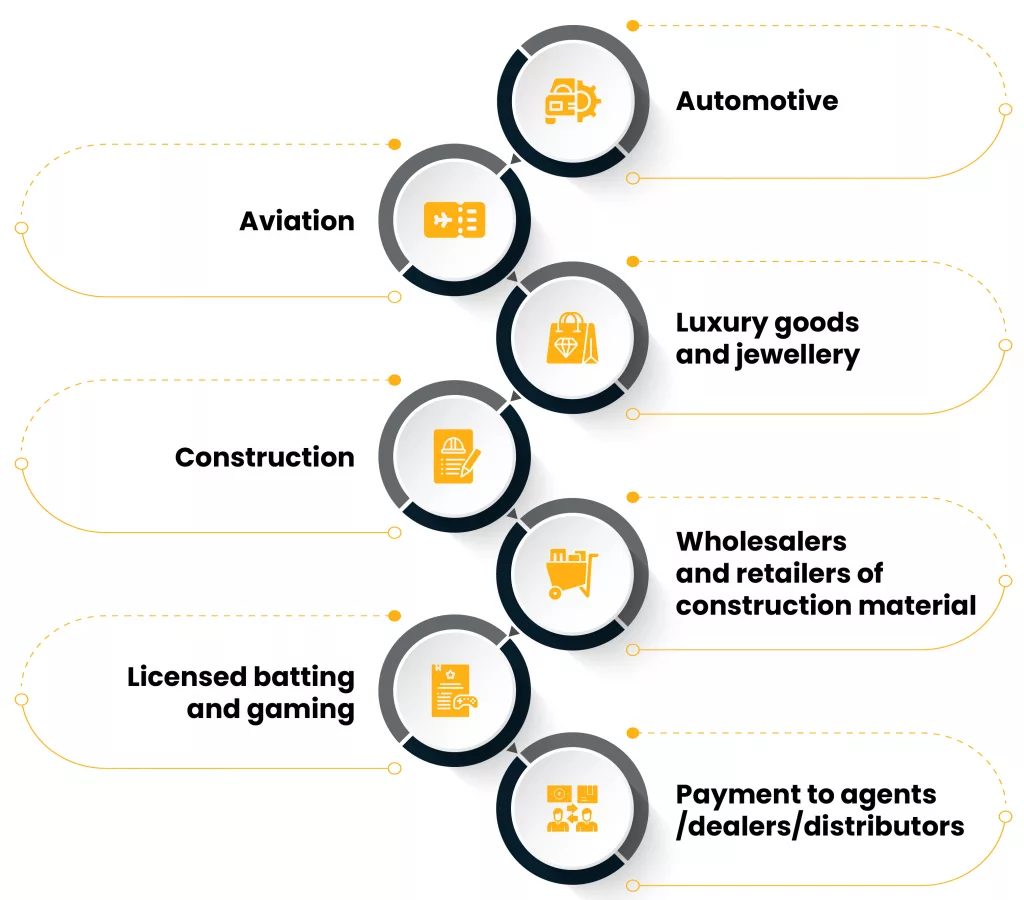

Here is the list of business transactions that cannot issue consolidated e-invoices.

Transactions under which consolidated e-invoices are not allowed

- Automotive: Sale of any motorcycle.

* Motor vehicle refers to a vehicle of any description, propelled using a mechanism contained within itself, constructed or adapted to be capable of being used on roads, and includes a trailer.

- Aviation: Sale of flight tickets, Private charter flights

- Luxury goods and jewellery

* Details not released yet. Till then, consolidated e-invoicing is allowed.

- Construction: Construction contracts undertaken by a contractor

- Wholesalers and retailers of construction material: Sale of materials irrespective of volume

Construction material is defined as any type, size, and nature of the material, initial, temporary, intermediate or finished, whether manufactured locally or imported, used for the purposes of the construction industry as specified under the Fourth Schedule of Lembaga Pembangunan Industri Pembinaan Malaysia Act 1994

- Licensed batting and gaming: Payments to winners for all batting and gaming activities

* Exemption – payment in casino and from a gaming machine

- Payment to agents/dealers/distributors

* Under Section 83A(4) of the Income Tax Act 1967, “agent, dealer or distributor” refers to any person who is authorized by a company to act as its agent, dealer or distributor and who receives payment (whether in monetary form or otherwise) from the company arising from sales, transactions or schemes carried out by him as an agent, dealer or distributor

However, suppliers face challenges in getting details from buyers, which requires them to issue e-invoices. This authority has provided a concession for filling out details as follows:

(a) For Malaysian individuals to provide either:

- TIN;

- MyKad / MyTentera identification number; or

- Both TIN and MyKad / MyTentera identification number.

(b) For non-Malaysian individuals to provide either:

- TIN assigned by IRBM (if not assigned, use general TIN “EI00000000020”). OR

- Both TIN and passport number / MyPR / MyKAS identification number.

For the transactions with the former and current ruler and ruling chief, for the former and current consort of a ruler of a state with specific titles and Consular offices and diplomatic officers, consular officers, and consular employees suppliers are allowed to replace the Buyer’s details with the information as follows:

- Buyer’s Name – Supplier to input “General Public” in the e-Invoice

- Buyer’s TIN- Supplier to input “EI00000000010” in the e-Invoice

- Buyer’s Registration/ Identification Number/ Passport Number, address, contact number, and SST registration number – Supplier will input “NA.”

- Description of Product/ Services – IRBM allows one or a combination of the following method

- The summary of each receipt is described as separate line items.

- A chronological list of receipts is described in separate line items, i.e., where there is a break of the receipt number chain, the next chain shall be included as a new line item.

- Branches or locations will submit consolidated e-invoices as per either of the above methods for receipts issued by them.

For the transaction with the Government, State government and state authority, Government authority, local authority, Statutory authority, and statutory body, Facilities provided by the government, authority, or body, the buyer’s TIN shall be “EI00000000040.”

Suppliers’ options for e-invoice issuance to Buyers

Suppliers have various options for issuance of e-invoices, which allow buyers to request e-invoices at Buyer’s convenience.

These options accommodate Buyers’ request for an e-invoice immediately after the transaction or later, subject to Buyers’ preferences.

The options provided in the guidelines are suggestions; suppliers can add any method to improve the customer’s experience.

There are 4 methods provided in the guidelines

- Online platform (Retailer Web Portal / Mobile App):

This can be integrated with the IRBM MyInvois System to generate and validate the e-invoice upon request.

- Retailers’ Point-of-sale (POS) system:

The Retailer’s POS system can be integrated with the IRBM MyInvois System to generate e-invoices in real-time. Buyers must provide their details to the Retailer (Supplier) at the point of purchase to generate the e-invoice upon request.

- MyInvois Mobile App:

Retailers without a Retailer App or POS system can utilize the MyInvois Mobile App to issue the e-invoice to Buyers upon request. Retailers (Suppliers) must input the details required to issue an e-invoice.

- Post-Transaction Request via Online Platform (Retailer Web Portal / Mobile App):

Buyers who did not request an e-invoice at the point of purchase can still request one through the Web Portal or Mobile App developed by the Retailers (Suppliers).

Conclusion

While the IRBM’s e-invoicing guidelines will keep changing based on the requirements and problems faced in practical operation, IRBM will always ensure the smooth running of business activities. Stay connected to gain a detailed understanding of them. Visit our e-book on e-invoicing in Malaysia: A Complete Guide” to comprehensively understand Malaysia’s e-invoicing.