The IRBM has published general and specific guidelines for regulating and complying with e-invoicing in Malaysia. These guidelines provide details about processing e-invoices using different methods or models. This article will delve into a comprehensive explanation of how the e-invoice will work using specified models.

E-invoicing Modes: Overview

There are primarily two modes to comply with E-Invoice requirements:

- MyInvois Portal hosted by IRBM

- Application Programming Interface (API):

- Direct integration of taxpayers’ Enterprise Resource Planning (ERP) system with MyInvois System

- Through Peppol service providers

- Through non-Peppol technology providers

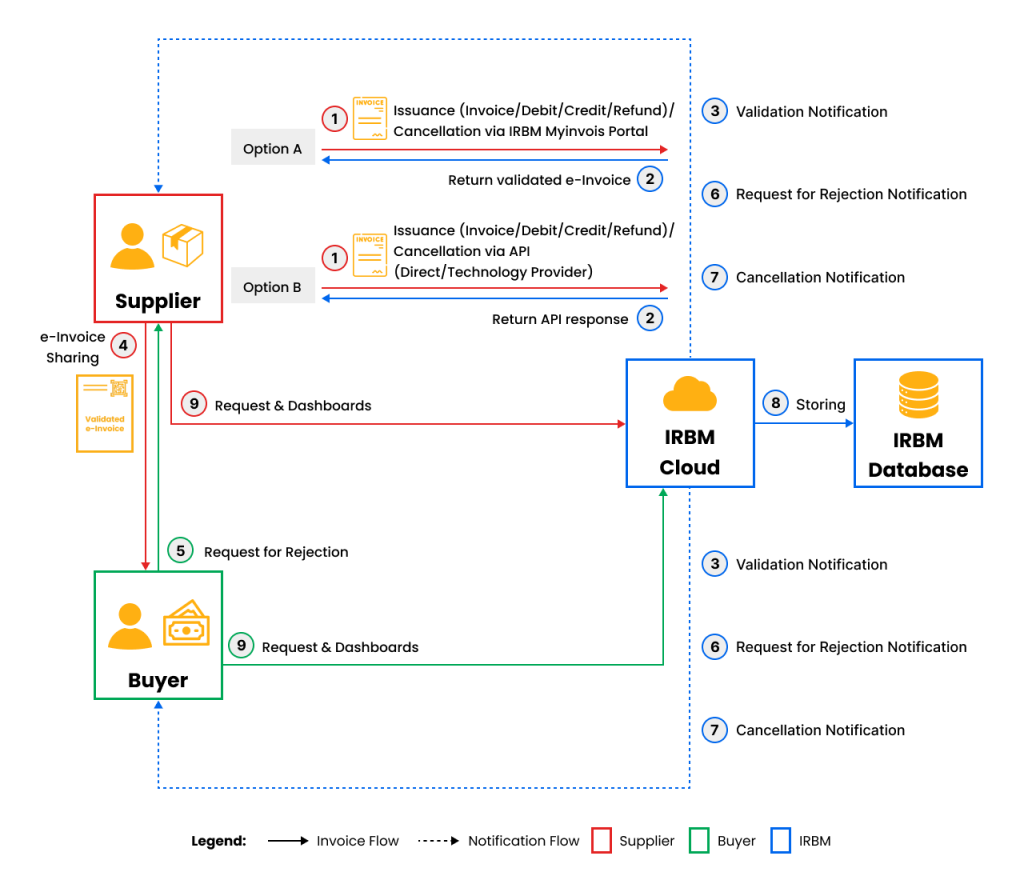

Step by Step of the process workflow for both methods:

Step-1 Generating and issuing e-invoice

After selling/supplying goods or services, the first step is to make a sales invoice, which is transmitted to the IRBM.

The invoice can be shared directly on the MyInvois portal by manually entering the transaction details individually or in bulk for multiple transactions.

The invoice can be shared via API; with direct integration, or through a third-party solution or PEPPOL access points, which automate its generation, verification, and transmission.

Step-2 E-invoice validation

IRBM validates the invoice shared on the portal in real-time and embeds a Unique identification number. Then, via portal or API, IRBM sends the supplier an e-invoice in PDF format.

Step-3 Notification of validation

IRBM, via the MyInvois portal or API, notifies the buyer and supplier about the successful clearance of the invoice or buyer rejection request.

Step-4 Invoice Sharing

The validated invoice must include a QR code that both buyer and supplier can use to check the invoice status. The supplier must share the invoice with the buyer.

Step-5 Rejection or cancellation of Invoices

The buyer can request the rejection of the invoice, or the supplier can cancel the invoice shared with IRBM within 72 hours of its sharing directly on the MyInovis portal or with the help of third-party tools.

Step-6 Storing e-invoice

All validated invoices shall be stored in the IRBM database, and taxpayers must retain sufficient records and documentation.

Step-7 Reporting and Dashboard service for taxpayers

Through MyInvois Portal or third-party solutions, taxpayers can request and retrieve e-invoices. It provides essential details such as the invoice date, amount, invoice status, and other relevant information submitted to IRBM in the specific format.

Critical considerations of both methods for effective decision-making:

MyInvois Portal

- Accessible to all taxpayers.

- Businesses requiring the issuance of e-invoices with API unavailability.

- Requires taxpayers to fill in the information in the pre-defined form or

- IRBM-specified spreadsheet form.

Through API

- It is ideal for large organizations or taxpayers with a high volume of transactions.

- Requires upfront investment in technology and current ERP adjustments.

- Easy to access with less effort

Conclusion

IRBM has analyzed the market trends and methods adopted worldwide to offer various e-invoicing options that meet business requirements. By providing these models, businesses can evaluate their business needs, financial capabilities, e-invoice generation volume, and other requirements.

This strategic approach facilitates compliance and supports diverse business environments, ensuring that companies of all sizes can efficiently integrate e-invoicing into their operations. As Malaysia approaches digitalization in tax administration, these models will play a crucial role in fostering a transparent and efficient tax ecosystem.