Electronic invoicing is a process aimed to transform the traditional practice of issuing paper invoices to digitalize the process for the exchange of invoices in a structured electronic format between buyer and seller through a unified process. E-Invoicing also provides real-time invoicing data to the government and helps in plugging revenue leakages.

Applicability of the mandate to generate e-Invoices

The e-Invoicing regulations mandate all natural or legal persons who carry on economic activity and are registered for VAT in KSA or are required to be registered for VAT in the KSA to generate e-Invoices and comply with the e-Invoicing provisions. Thus, the following categories of taxpayers would be covered within the scope of e-Invoicing:

- A taxable person/business who is a resident in the Kingdom,

- The customer or any third party who issues a tax invoice on behalf of the taxable person that is a resident in KSA according to the VAT Implementing Regulation.

The taxpayers who are not residents of the KSA for the purpose of VAT laws are not required to issue electronic invoices for supplies or amounts received, which are subject to tax in KSA.

The documents covered under the scope of e-Invoicing

E-Invoices (tax invoices) are required to be generated for all the transactions that are subject to VAT while electronic (debit and credit) notes are required for the following transactions:

- Cancellation or suspension of the supplies after its occurrence either wholly or partially.

- In case of essential change or amendment in the supply, which leads to the change of the VAT amount,

- Amendment of the supply value which is pre-agreed upon between the supplier and consumer,

- In case of goods return or refund for services.

Types of e-Invoices

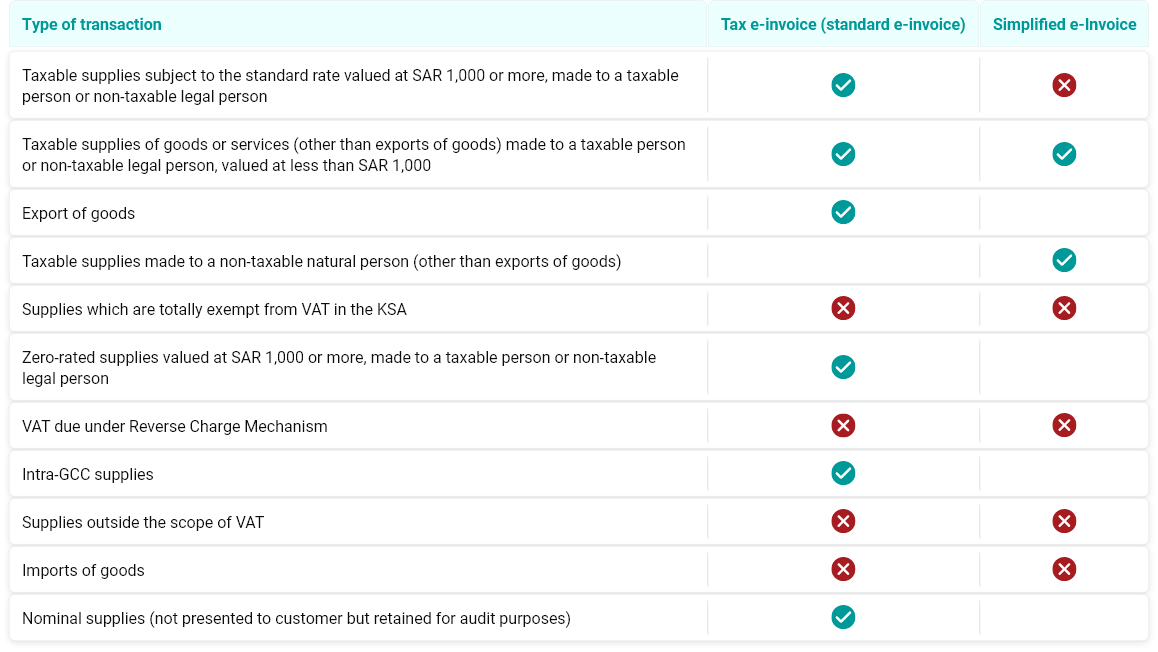

The e-Invoices and their associated notes can be either the standard invoice or simplified, depending on the recipient or purpose for which they are issued as summarized below:

Supplies covered under e-Invoicing in KSA

Baring few specified cases such as exempt supplies or import of goods, e-Invoicing will be applicable for all kind of outward supplies as mentioned below:

- Supplies of goods and services are subject to the standard VAT rate or Zero rate if valued at SAR 1,000 or more.

- Export of goods.

- Intra-GCC supplies.

- Nominal (free of cost) supplies having value more than 200 SAR.

- Advance payments.

Transactions that do not require the issuance of e-Invoices

Taxable persons are not required to generate e-Invoices and/or notes for the following categories of transactions:

- Exempted supplies.

- Advance payments relating to exempted supplies.

- Supplies subject to VAT pursuant to Reverse Charge Mechanism.

- Import of goods.

Phases for implementation of e-Invoicing

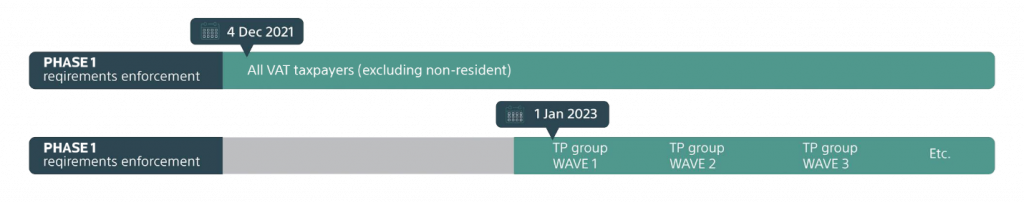

The implementation of the change of this level and magnitude requires the partnership between the taxpayers, tax authorities, and the facilitating service providers. To smoothen the transformation, e-Invoicing in the KSA is being implemented in the phased manner.

In the first phase, businesses were required to generate and store compliant electronic invoices using compliant e-Invoicing systems. The first phase has been enforced from 4th December 2021 for all the resident taxpayers and any other parties issuing tax invoices on behalf of the suppliers subject to VAT.

The second phase, likely to be enforced in waves, starting from January 2023, will require the e-Invoicing software or systems of the taxpayers to be integrated with ZATCA, the governing authority for tax and e-Invoicing in the KSA through standardized protocol to enable data interoperability between the government’s system and the taxpayers. The businesses with turnover above 3 Billion SAR would be covered under the wave 1 of the phase 2.

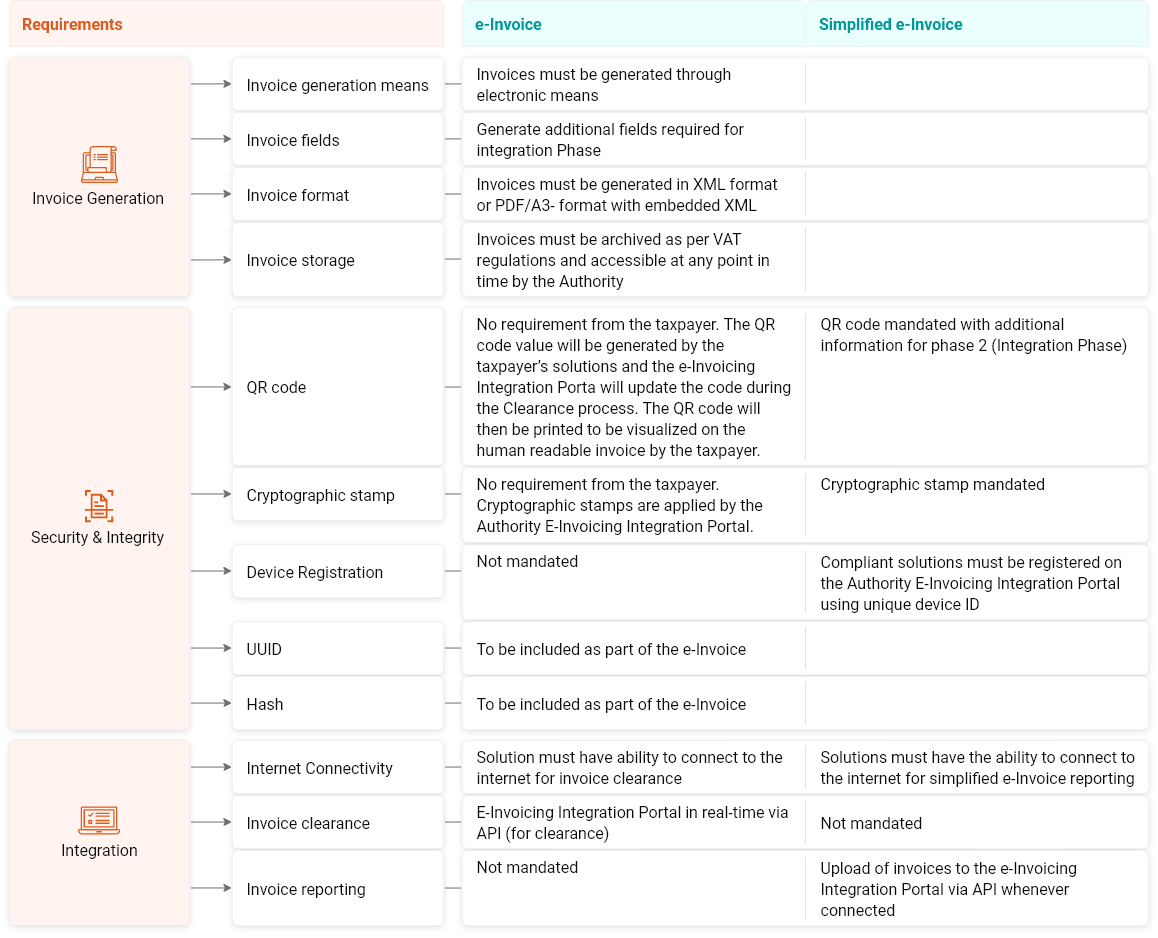

Generation phase

Phase 1 required the taxpayers to generate and store tax invoices and associated notes through electronic solutions compliant with the e-Invoicing requirements and specifications issued by the ZATCA. Manual invoices issued by such taxpayers are no longer considered as compliant invoices.

The invoices issued during the phase 1 shall include the specified mandatory fields, QR code would be required only for B2C supplies.

Integration phase

Phase 2, also known as the integration phase will be rolled-out in waves, not earlier than January 2023, for the targeted taxpayer group. Phase 2 will entail additional technical requirements that e-Invoicing systems must comply with, the integration of taxpayer electronic systems with ZATCA, and the issuance of electronic invoices in a specific format.

Each standard e-Invoice and associated credit/debit notes must be cleared by the ZATCA as a prerequisite for sharing them with the buyers and for such e-Invoice to be regarded as legal and valid. Simplified e-Invoices must be reported to the tax authority within 24 hours from issuance.

Prohibited functions for e-Invoicing solution:

To ensure the sanity and authenticity of the data, the ZATCA requires the e-Invoicing solutions to have user management capabilities and prevent unauthorized operations that may lead to fraudulent manipulation or access to data for any purpose. Besides, in the integration phase, the additional restrictions shall include tamper-proofing mechanisms that prevent any modification or tampering with invoices or the solution itself and must be able to record and detect any tampering attempts.

- Anonymous access

- Ability to operate with a default password

- Absence of user session management

- Allow alteration or deletion of generated e-Invoices or their associated notes

- Allow for log modification/ deletion

- Generate inaccurate timestamps

- Non-sequential log generation

- Invoice counter reset

- Ability to generate more than one invoice sequence at any given time

- Software time changes or modifications of timestamp

- Export of stamping keys

Choosing the right e-Invoicing solution

E-Invoicing is becoming a necessity for ensuring tax compliances, but have you ever considered the benefits of e-Invoicing for your businesses or maybe wondered what it takes for an e-Invoicing solution to deliver more than just your compliance needs. The right service provider will ensure that e-Invoicing gives you a competitive edge and that you have access to all markets.

Let’s look at factors to keep in mind as you choose a service provider for your e-Invoicing journey:

- Choosing the service provider who can keep up with the e-Invoicing mandate everywhere you do business can play a big role in implementation success.

- E-Invoicing regulations may require specific requirements for the data to be stored within the borders of the country. Choose the service provider that can help in navigating the regulatory landscape and comply with local regulations across the countries.

- An e-Invoicing service provider with an open network, such as Peppol members can facilitate interoperability of invoices between businesses on separate networks. As a result, the businesses choosing an open network can connect to the government platforms and other standardized frameworks for secure cross-border exchange of electronic business documents, leaving room for scalability.

- A service provider with ERP integration capabilities and an understanding of the financial system can help in minimizing the system and format changes.

- The need for real-time invoicing makes it a business-critical service and any interruption can affect business operations. Hence choose to invest in the service provider that invests in a superior support.