Introduction

For a decade, government authorities worldwide have leveraged technology and digitization in their tax administration management to ensure efficiency, accuracy, and transparency in transaction reporting. The introduction of e-invoicing is a revolution in digitization, going paperless and ensuring reduced tax fraud and evasion.

Singapore was prominent among the countries as it had obligated people to use electronic document exchange via the PEPPOL network for B2G transactions. The Infocomm Media Development Authority (IMDA) is responsible for e-invoicing in Singapore, which became the first accredited PEPPOL authority outside Europe to operate e-invoicing to help businesses reduce costs, stay paperless and green, improve efficiency, and enjoy faster processing.

E-invoicing Journey in Singapore

Significant Milestones in Singapore’s Nationwide e-invoicing.

- May 2018: IMDA becomes the first Peppol Authority outside Europe.

- January 2019: Nationwide E-invoicing network launched with 11 Access Point providers.

- 2019: Introduction of Peppol Ready solution accreditation; over 50 providers connected by January 2020.

- January 2020: The Singapore government enables suppliers to submit e-invoices via the network, becoming the preferred submission channel.

- March 2020: The E-Invoicing Registration Grant has been announced, incentivizing businesses to join by 31 December 2020.

- September 2020: Network renamed Invoice Now

Overview

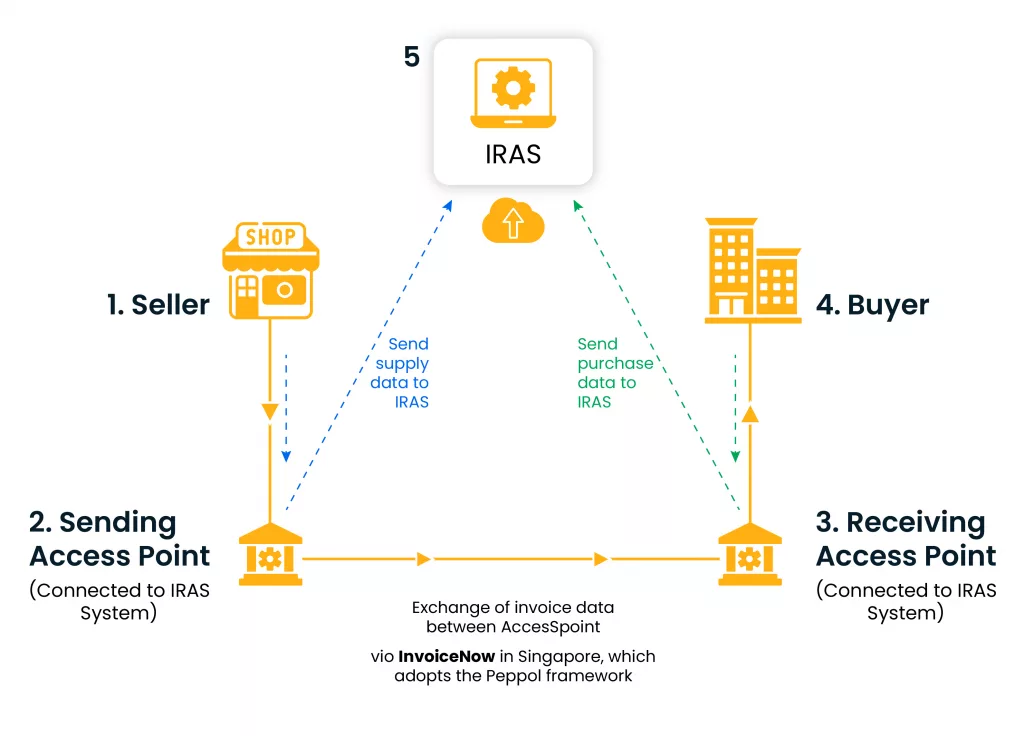

Earlier, businesses in Singapore issued invoices in traditional format with human help in paper or email form, which may have discrepancies and is also time-consuming. To accelerate this process and make the payment process transparent and faster, IMDA introduced the 4 Corner PEPPOL framework, which changed how invoices are processed in Singapore.

Singapore used BIS Billing 3.0 UBL XML format as per the PEPPOL framework, which has four corners: seller, Seller’s access point, Buyer, and Buyer’s access point. This framework allows users to select their ERP based on their requirements and transfer e-invoices with trading partners using different ERPs.

Four Corner PEPPOL Framework Process Flow

- The seller aims to transfer the invoice to the buyer. The invoice sent by the seller (Corner-1) through its ERP, regardless of its format, will be converted into a standard format by the seller’s access point (Corner-2).

- The Global repository will provide information about the receiving access point to the seller’s access point to transfer the invoice over the network.

- The Buyer’s access point (Corner-3) will receive the invoice and send it to the buyer (Corner-4) in the buyer’s preferred format.

This helped with faster processing of invoices, reduced errors, and improved transparency and efficiency.

Invoice Now

In September 2020, InvoiceNow, a nationwide e-invoicing network based on PEPPOL’s e-delivery network, was launched to transfer invoices in a standard format.

InvoiceNow will facilitate invoice reporting to IRAS authorities and quickly transfer e-invoices among trading parties through the respective PEPPOL access points. This move supports the ongoing digitization trend, enhances interoperability, streamlines GST administration, and standardizes invoices nationwide.

InvoiceNow will have 5 corner models of the PEPPOL CTC framework for real-time tax controls facilitated by IRAS. The added corner will be IRAS; SMEs may directly integrate InvoiceNow, while larger enterprises receive support from IMDA-approved Access Point Providers connected to InvoiceNow to transfer Invoice data to IRAS via API. This will help transfer a copy of the invoice to IRAS whenever businesses receive or send it via the InvoiceNow network or record it on the InvoiceNow solution.

Whether e-invoicing is mandatory?

Currently, the issuance of e-invoicing is not mandatory for any B2B or B2G transactions. However, it is advisable to use InvoiceNow for the issuance of invoices as the IRAS has already planned the soft launch and then making it mandatory in a phased manner as follows:

| Date | Phase |

| From 1st May, 2025 | As a part of a soft launch, voluntary adoption for all GST-registered business |

| From 1st Nov 2025 | For the newly incorporated company that registers for GST voluntarily. |

| From 1st April 2026 | For all new voluntary GST registrants. |

For the remaining GST registrants, e-invoicing applicability will be announced based on feedback received in the current phase.

Important Notes- The newly incorporated company means the company was incorporated within 6 months from the date of submitting its application for GST registration.

Transactions requiring the use of GST InvoiceNow.

Transactions required to use InvoiceNow solutions to report invoices to IRAS are as follows:

- Standard-rated supplies, excluding Reverse charge supplies.

- Standard-rated purchases on which input tax claims are made or to be made, excluding reverse charge purchases.

- Zero-rated supplies

- POS (Point-of-sales) supplies are where businesses can send aggregated data to IRAS.

Businesses excluded from the use of GST InvoiceNow

- Overseas entities (including overseas vendors that are registered under the Overseas Vendor Registration regime)

- Businesses registered under the Reverse Charge Regime

Due Date to Transmit Invoice Data to IRAS via InvoiceNow

The Invoice data can be transmitted at the earliest of:

The date of filing the relevant GST return

Or

The due date for filing the relevant GST return

A relevant GST return refers to the return filed for the period corresponding to when the invoice was issued or the date shown on the supplier’s tax invoice.

Procedure for early adoption of InvoiceNow.

As stated above, it is advisable to issue invoices via InvoiceNow as soon or later. It will be mandatory for all segments of business to issue invoices through InvoiceNow. Here is a quick procedure to prepare the business to use InvoiceNow:

Current Preparation

- Evaluate your current accounting software/ERP and ensure InvoiceNow is enabled.

- If not, Businesses can check if the preferred solution is listed on IMDA’s pre-approved e-invoicing solution provider list or may also consider having free solutions with InvoiceNow features. For large enterprises, using IMDA pre-approved access point providers is ideal.

- Contact your Solution Provider or Access Point Provider to register your business in the SG Peppol Directory using your UEN and obtain your Peppol ID.

Preparation for reporting to IRAS

- Ensure that the InvoiceNow solution is connected to IRAS via API. Your solution provider or Access Point provider can help you with this.

- Test the workflow to ensure efficient transfer of e-invoice across 5 corners.

Benefits of e-invoicing

E-invoicing has many benefits, leading authorities worldwide to implement it in the tax administration system. Here are the benefits the Singapore business can gain from e-invoicing:

- E-invoicing ensures reduced errors and human intervention, making the process more transparent, accurate, and faster.

- It ensures a streamlined process with invoice transmission in a standard format without human intervention in sending, receiving, recording, or reporting the invoice.

- It helps with efficient paperless invoice record-keeping.

- As the process becomes faster, the payments are released faster, which helps in efficient cash flow management,

- Since the transactions are already transmitted to IRAS, there are fewer chances of audit demand from authorities.

- It helps in accurate tax calculations and ITC claims.

- Businesses using solutions from service providers can take advantage of additional features such as auto-verification of invoice data before transmission, automatic tax calculations, and GST compliance needs.

Why Cygnet?

Cygnet is dedicated to excellence in tax transformation, finance transformation and compliance solutions, and e-invoicing solutions. We excel in e-invoicing, GST and VAT compliance, purchase digitization, accounts payable automation, Source-to-Pay Automation, and billing solutions. Our smart, scalable, dynamic platforms integrate seamlessly with ERP systems, ensuring efficient and error-free tax management. Our government-recognized platforms serve markets across the Americas, the UK and Europe, Africa, the Middle East, and Asia Pacific.

CYGNET.ONE empowers organizations to achieve digital transformation in the business process through co-ideation, co-creation, co-innovation, and co-evolution. Our expertise extends to Compliance Transformations, Digital & Quality Engineering, Enterprise Modernization, Data, AI & Analytics Hyper Automation, Test Automation, Digital Signature, and more.

With a global presence in diverse markets and industries, CYGNET.ONE serves as a one-stop destination for intelligent solutions, delivering value from ideation to execution and ultimately driving success for clients and partners worldwide.

Conclusion

In conclusion, Singapore’s adoption of e-invoicing marks a transformative shift towards digital efficiency and transparency in businesses and tax administration. By adhering to PEPPOL standards and implementing the 5 Corner framework, the initiative aims to streamline invoicing processes, minimize errors, and ensure compliance with regulatory requirements. Businesses embracing e-invoicing can expect accelerated processing times, improved cash flow management, and enhanced accuracy in tax reporting, positioning them competitively in the global digital economy.