With the evolving economy, businesses need more financial support from financial institutions to operate effectively. This demand for financial support also raises the need for critical risk assessment of borrowers/insurees to ensure that BFSI does not suffer economic loss or that fraudulent activities are not conducted against them.

Lenders collect and evaluate vast volumes of data, including bank statements, personal details, business details, credit scores, market value, etc., for risk and credit assessment processes to ensure the authenticity of borrowers/customers. Analyzing volumes of data and extracting crucial information from it manually or with traditional methods is difficult and time-consuming, which may be prone to human error and slow down the lending process.

The VP of Advanced Analytics & AI at CIBC, Ozge Yeloglu, once rightly said, “Big data may be cheap to collect, but it’s expensive if you don’t know what you want to get out of it.”

It is essential to have the correct data and gain valuable insights from it. A bank statement is one of the crucial documents any BFSI (banking, financial service, insurance) can use when lending money or providing the right policy to the business organization.

However, extracting and evaluating bank statements is challenging with traditional methods; this is where automation and AI are leveraged to make human tasks faster and easier. This blog will explain how AI helps in bank statement analysis.

What is bank statement analysis?

Bank statement analysis is a prescribed process of extracting the bank statement information and analyzing the opening-closing balance every month and year, income and expenses credited or debited, investments made, undue tax payments, unexplained money receipts or transfers, recurring transactions, etc., which gives insights on the financial transaction and authenticity of any person/business.

Why is Bank Statement Analysis Crucial?

As a standard practice worldwide, most banks or financial institutions require their borrowers to submit the past three months’ bank statements as essential documents to evaluate risk and credibility.

Risk and credit assessment are crucial when dealing with financial transactions. They provide insights into the borrower’s creditworthiness, such as income stability, investment plans, other debts, expenses, red-flag transactions, unexplained payments, and cash flow patterns, to ensure the borrower can repay the borrowed money and interest.

These assessments help make informed decisions regarding the borrower’s ability to pay, loan eligibility, the amount of money that can be borrowed, the rate of interest, and loan repayment duration.

Leveraging AI-driven bank Statement Analysis

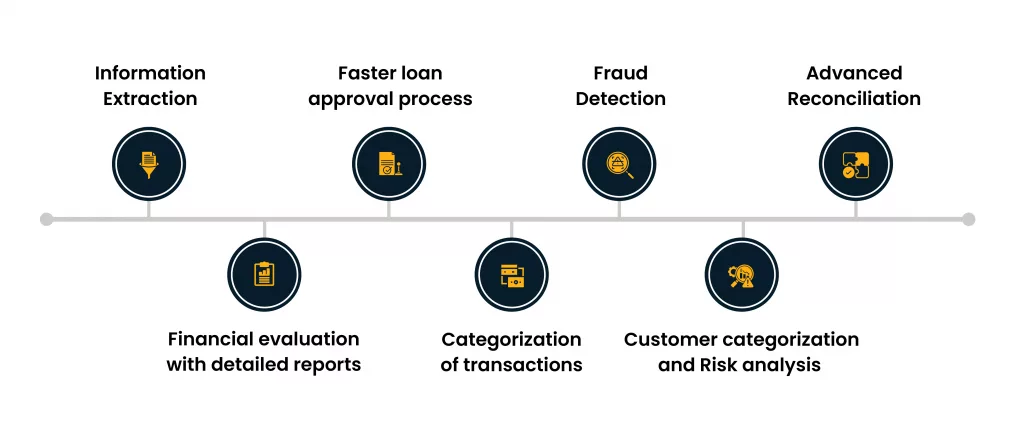

The role of AI in bank statement analysis is vital. AI has changed the way many processes are carried out. To analyze bank statements, AI can be leveraged as follows:

- Information Extraction

Technology like OCR/IDP (Intelligent Document Processing) can extract relevant information from statements in any format, such as XML, JSON, PDF, Word, etc.

This makes human tasks easy by eliminating the need to manually extract information regarding income, expenses, investments, debts, recurring and nonrecurring, etc., and facilitates underwriters’ evaluation of these data to ensure borrowers’ ability to repay loans.

- Categorization of transactions

Bank statements contain multiple transactions, including income, expenses, various investments (FDs, mutual funds, equity, and debt, etc.), debt payments, tax payments, advances given, and secured or unsecured loan claims.

These transactions can be categorized into their respective categories based on AI Algorithms, NLP/ML, and RPA technologies.

- Faster loan approval process

Gone are the days when loan processing was tiresome and lengthy. The entire process can be completed in a few minutes with AI-enabled automated software. Banks and fintech software offers an online loan application facility that allows the borrower to upload personal details and required documents, including bank statements.

The bank statement analyzer tools analyze the bank statement in minutes. Other personal and identity documents are cross-verified with government data, and AI software also fetches credit scores and GST scores.

Further, with the help of an account aggregator, the lending bank can fetch all the details related to the borrower’s banking activity, bank statements of all banks, GST returns, total investment and deposits, etc., and sanction the loan accordingly.

- Fraud Detection

Once the data is extracted and categorized from the bank statement, it can be reviewed by AI or humans. Having a regular, clean, and valid bank statement helps reduce risk. Machine learning models are trained to identify and verify crucial information and detect fraud or anomalies.

This will help lenders identify unexplained transactions, file tampering, incomplete or invalid data sets, or any other anomalies in bank statements, thereby deciding whether to lend money.

- Financial evaluation with detailed reports

AI-enabled bank statement analysis software can analyze borrowers’ financial health. The software uses all the historical data available alongside the current documents submitted to analyze a borrower’s exact financial position.

A customized dashboard with charts and graphs based on individual case requirements to make human analysis and review easier. For example, graphs for the percentage of income against total expense to ensure the borrower’s capacity to repay the money.

- Customer Categorization and Risk analysis

AI-powered bank statement analysis can segment customers into different categories based on their financial health. AI algorithms analyze income behavior, expense patterns, investment choices, saving options, etc., bifurcate them into different income categories, and determine the high- and low-risk profiles. This provides insights into the amount and type of loans/CC or financial product a borrower is eligible for.

- Advanced Reconciliation

AI-leveraged bank statement analysis tools facilitate advanced reconciliation to reconcile income, expenses, investments, savings, tax liability, etc., extracted from bank statements with financial statements, income tax returns, GST returns, and Credit agencies’ reports to verify the genuineness of the bank statement and ensure there is no fraud done for getting money.

Benefits of AI in Bank Statement Analysis

AI provides numerous benefits when blended with bank statement analysis tools. Find the list of a few benefits as follows:

- Data extraction from bank statements is more accurate as it eliminates human intervention.

- Quick response and faster processing with minimal turnaround time.

- Detailed insights and analysis on cash flow and income of borrowers.

- Immediate alerts on suspicious activities, file tampering, duplicate data, and red-flag transactions.

- User-friendly interface with easy access through the web, mobile apps, or other compatible devices.

- Ability to scale the voluminous data processing and evaluation without hindering its speed.

- Strong data encryption to protect customers’ sensitive data.

Steps to integrate AI tools into Bank Statement Analysis

- Evaluate current software and systems to identify and list down areas where AI is required.

- Based on the above evaluation, select appropriate AI tools that meet maximum requirements.

- Train AI models with historical data and evaluate the outcome.

- Enable customized features based on the bank statement analysis requirements.

- Run a pilot project and slowly integrate it in a phased manner based on the performance.

- Ensure robust compliance and security measures are met based on government rules and regulations.

- Ensure timely monitoring of the tools to ensure maximum accuracy.

Summary

Leveraging AI in bank statement analysis can transform a financial institution’s work by boosting efficiency, accuracy, and speed. Automation and AI streamline processes, offering efficient data extraction, transaction categorization, fraud detection, and comprehensive financial evaluations.

Enhanced fraud detection and financial evaluation provide detailed insights and customized reports, aiding informed decision-making. Accurate customer categorization and risk assessment allow tailored financial products while ensuring security and compliance.

Leveraging AI for bank statement analysis helps financial institutions improve competitiveness and customer needs and foster a more secure, efficient financial ecosystem.