This article explains the compliance guidelines a supplier must follow for transactions with a buyer in which the buyer may or may not request an e-invoice in Malaysia.

Practice before e-invoicing

Supplier issues receipts, bills, and invoices in hardcopy/softcopy format to record supply transactions with buyers.

Practice after e-invoicing implementation

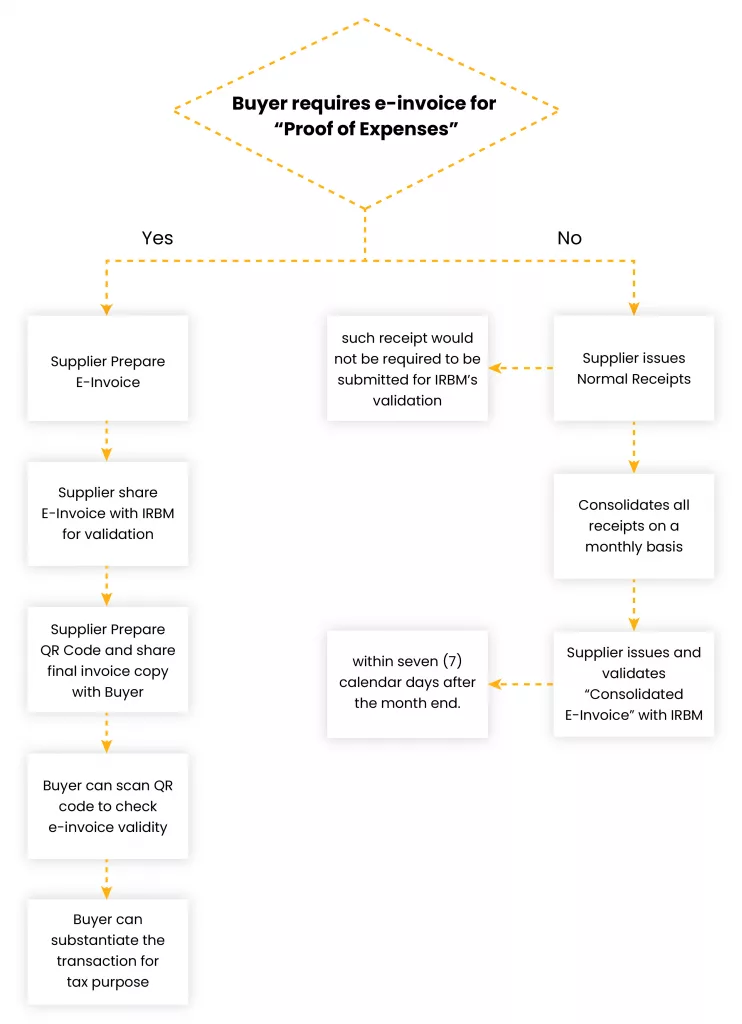

The supplier must issue e-invoices to record all the transactions. However, in some cases, where the buyer is an end customer (B2C transactions) or has a specific business, they may not require e-invoices as proof of expense.

In such cases, the supplier can consolidate the transaction with buyers who do not require e-invoices and issue consolidated e-invoices every month.

Procedures for e-invoicing compliance when the buyer requires e-invoices and when the buyer does not e-invoice as proof of expense.

Scenario-1 When Buyers require e-invoices

Procedure:

- Supplier asks for confirmation from the buyer whether an e-invoice is required.

- If the buyer requires an e-invoice, the buyer must provide certain details to the supplier to issue the e-invoice.

- Upon receipt of the details from the buyer, the supplier will fill in the remaining details and issue e-invoices per standard guidelines based on the type of model used by the supplier.

- The buyer shall use the validated e-invoice as proof of expense.

Details to be provided for e-invoice generation

By Buyer

| Field | For Malaysian Individuals | For Non-Malaysian Individuals |

| Buyer’s Name | Full name as per MyKad/MyTentera | Full name as per passport/MyPR/MyKAS. |

| Buyer’ TIN | Option 1- TIN only Option 2- MyKad/MyTentera identification number only Option 3 Both | Option 1- TIN only Option 2- Both * If TIN is unavailable, the supplier can use the general TIN as per appendix-1 of specific guidelines, along with passport/MyPR/MyKAS identification number. |

Above this Buyer’s Registration/Identification Number/Passport Number, address, contact number, and SST registration number are also required. However, If an individual Buyer is not registered for SST, the Supplier inputs “NA.”

By Individual Shipping Recipients for issuance of Annexure

| Field | For Malaysian Individuals | For Non-Malaysian Individuals |

| Shipping Recipient’s Name | Full name as per MyKad/MyTentera | Full name as per passport/MyPR/MyKAS. |

| Shipping Recipient’ TIN | Option 1- TIN only Option 2- MyKad/MyTentera identification number only Option 3 Both | Option 1- TIN only Option 2- Both * If TIN is unavailable, the supplier can use the general TIN as per appendix-1 of specific guidelines, along with passport/MyPR/MyKAS identification number. |

Additionally, the shipping recipient’s address is required.

As per specific guidelines, When the Buyer or Shipping recipient either has a TIN or MyKad/MyTentera identification number instead of both, the supplier can replace the details as follows:

| Option | Applicable for | Data provided | Data Field | Supplier’s Input |

| 1 | Both Malaysian and non-Malaysian individuals | If individual Buyer/Shipping Recipient only provides TIN | Buyer’s/Shipping Recipient’s TIN. | TIN provided |

| Buyer’s/Shipping Recipient’s Registration/Identification Number/Passport Number | “000000000000” | |||

| 2 | For Malaysian Individuals | If an individual Buyer/Shipping Recipient only provides a MyKad/MyTentera identification number: | Buyer’s/Shipping Recipient’s TIN. | “EI00000000010” |

| Buyer’s/Shipping Recipient’s Registration/Identification Number/Passport Number | Supplier inputs MyKad/MyTentera identification number provided |

Scenario 2: Where the buyer does not require an e-invoice

Procedure

- The supplier will ask for confirmation from the buyer regarding the requirement of an e-invoice.

- If the buyer does not require an e-invoice, the supplier shall issue a receipt to the buyer, which is not required to be submitted to IRBM for validation.

- Supplier is allowed to aggregate all the transactions with buyers to whom receipts are issued and must issue consolidated e-invoice as proof of his income within 7 calendar days after the end of the month in which receipts were issued.

- The issuance of consolidated e-invoice is similar to the issuance of regular e-invoice.

- Once the consolidated e-invoice is validated, the IRBM will notify only the supplier, not the buyer.

It is proof of income for the supplier. Therefore, there is no requirement to send this to the buyer, and the buyer cannot request for rejection of the consolidated e-invoice.

Points to be considered while issuing a consolidated invoice

- Maximum size per submission – 5 MB

- Maximum e-invoices per submission- 100

- Maximum size per e-invoice- 300 KB

To meet this requirement, the supplier can split the receipts into several consolidated e-invoices.

Consolidation does not apply to self-billed e-invoices except in the following circumstances.

- Acquisition of goods or services from individual taxpayers not doing business.

- Interest payment to the public, regardless of businesses or individuals.

If the buyer to whom the receipt is issued requires an e-invoice, he can request it from the supplier within 1 month of the transaction. This allows the supplier to set the cut-off for the receipts to be aggregated into the consolidated e-invoices.

About the consolidated e-Invoice, the Supplier will be required to complete the required fields as follows:

- Buyer’s Name – Supplier to input “General Public” in the e-Invoice

- Buyer’s TIN- Supplier to input “EI00000000010” in the e-Invoice

- Buyer’s Registration/ Identification Number/ Passport Number, address, contact number, and SST registration number – Supplier will input “NA.”

- Description of Product/ Services – IRBM allows one or a combination of the following method

- The summary of each receipt is described as separate line items.

- A chronological list of receipts is described in separate line items, i.e., where there is a break of the receipt number chain, the next chain shall be included as a new line item.

- Branches or locations will submit consolidated e-invoices for receipts they issued using either of the above methods.

Note that for any method businesses adopt, the receipt reference number for each transaction must be included in this field in the consolidated e-invoice.

To learn about the transactions for which consolidated e-invoices cannot be issued, visit our blog, “Malaysia’s Guidelines on Activities Ineligible for Consolidated E-Invoicing.”