Introduction

The GST Council is making constant efforts to streamline the tax process and ensure transparency within business transactions. To facilitate such transparency, the GST Council keeps on introducing new features in their portal and in the tax compliance process. One such feature is the introduction of an Invoice Management System (IMS) to streamline the ITC availing process. We shall understand IMS, how it works, What is its impact, etc., in this content.

Invoice Management System: Meaning

The Invoice Management System is a new feature in the GST Portal where a recipient of an invoice can accept, reject, or keep pending invoices issued by the supplier. This will allow the matching of recipients’ records with invoices issued by suppliers in GSTR-1 to avoid errors in claiming ITC.

Roll-out time of Invoice Management System

This facility shall be available to the taxpayer from 1st October onwards on the GST portal.

Functioning of Invoice Management System

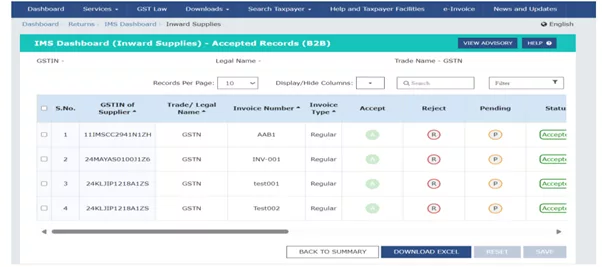

- When suppliers upload or save invoices in GSTR-1, IFF, or GSTR-1A, the corresponding invoice will automatically appear in the recipient’s IMS dashboard. Image as follows:

- All invoices or records reported or saved by the supplier in their GSTR-1, IFF, or GSTR-1A will be available on the recipient’s IMS dashboard for review and action. Suppliers can also track the actions taken by recipients on these invoices within the IMS.

- The recipient has the option to accept, reject, or keep an invoice pending for future action. Only those invoices that the recipient accepts will be included in their GSTR-2B as eligible Input Tax Credit (ITC).

- These actions can be performed from the moment the supplier saves records in GSTR-1, IFF, or GSTR-1A, up until the recipient files their GSTR-3B.

- If the recipient does not take any action on an invoice in IMS, it will be treated as deemed accepted and will automatically move to GSTR-2B as an accepted invoice.

- If the supplier amends any invoice details before finalizing GSTR-1, the amended version will overwrite the original invoice in IMS, regardless of the action previously taken by the recipient.

- In the case where a supplier amends a filed invoice through GSTR-1A, the updated invoice will appear in IMS. However, the related ITC will only reflect in the recipient’s GSTR-2B for the following month.

- Pending invoices can be addressed at any point in the future but must adhere to the limitations set by Section 16(4) of the CGST Act, 2017.

- During the generation of GSTR-2B, only those invoices that have been filed by the supplier will be considered for ITC calculation. Based on actions taken and the cut-off dates, a draft GSTR-2B will be available for the recipient on the 14th of the subsequent month. Even after the draft GSTR-2B is generated, recipients can still accept, reject, or leave invoices pending until they file GSTR-3B.

- If a recipient takes action on any invoice after the 14th of the month, they will need to recompute GSTR-2B. No further actions can be taken once GSTR-3B is filed for that period. Additionally, the GSTR-2B for the following month will not be generated until the recipient has filed GSTR-3B for the current month.

Invoice Management System (IMS) Workflow: Actions for Accept, Reject, and Pending Invoices

The Invoice Management System (IMS) allows recipients to manage outward supplies reported in GSTR-1, IFF, or GSTR-1A by suppliers. Based on recipient actions, invoices fall into three main categories: Accepted, Rejected, or Pending, with the corresponding impact on GSTR-2B and GSTR-3B filings.

- Accepted: Once an invoice is accepted, it is included in the ‘ITC Available’ section of the recipient’s GSTR-2B. The corresponding Input Tax Credit (ITC) is automatically reflected in the GSTR-3B for eligible ITC claims.

- Rejected: Rejected invoices are listed in the ‘ITC Rejected’ section of GSTR-2B. These records do not contribute to the ITC and will not appear in the recipient’s GSTR-3B.

- Pending: Pending invoices remain on the IMS dashboard for future action but are not included in the current month’s GSTR-2B or GSTR-3B. Recipients can later accept or reject these invoices. However, pending actions are restricted in specific cases such as:

- Original credit notes

- Upward amendments of credit notes

- Downward amendments to credit notes if the original was rejected

- Downward amendments to invoices/debit notes if the original was accepted and the GSTR-3B was already filed.

Conclusion

The Invoice Management System (IMS) is a vital feature in the GST framework that enhances the ITC claiming process by allowing recipients to accept, reject, or defer invoices. This system improves accuracy, reduces errors, and ensures seamless integration with GSTR-1/1A, GSTR-2B, and GSTR-3B. IMS fosters transparency and compliance, simplifying business tax management while strengthening India’s overall GST structure.