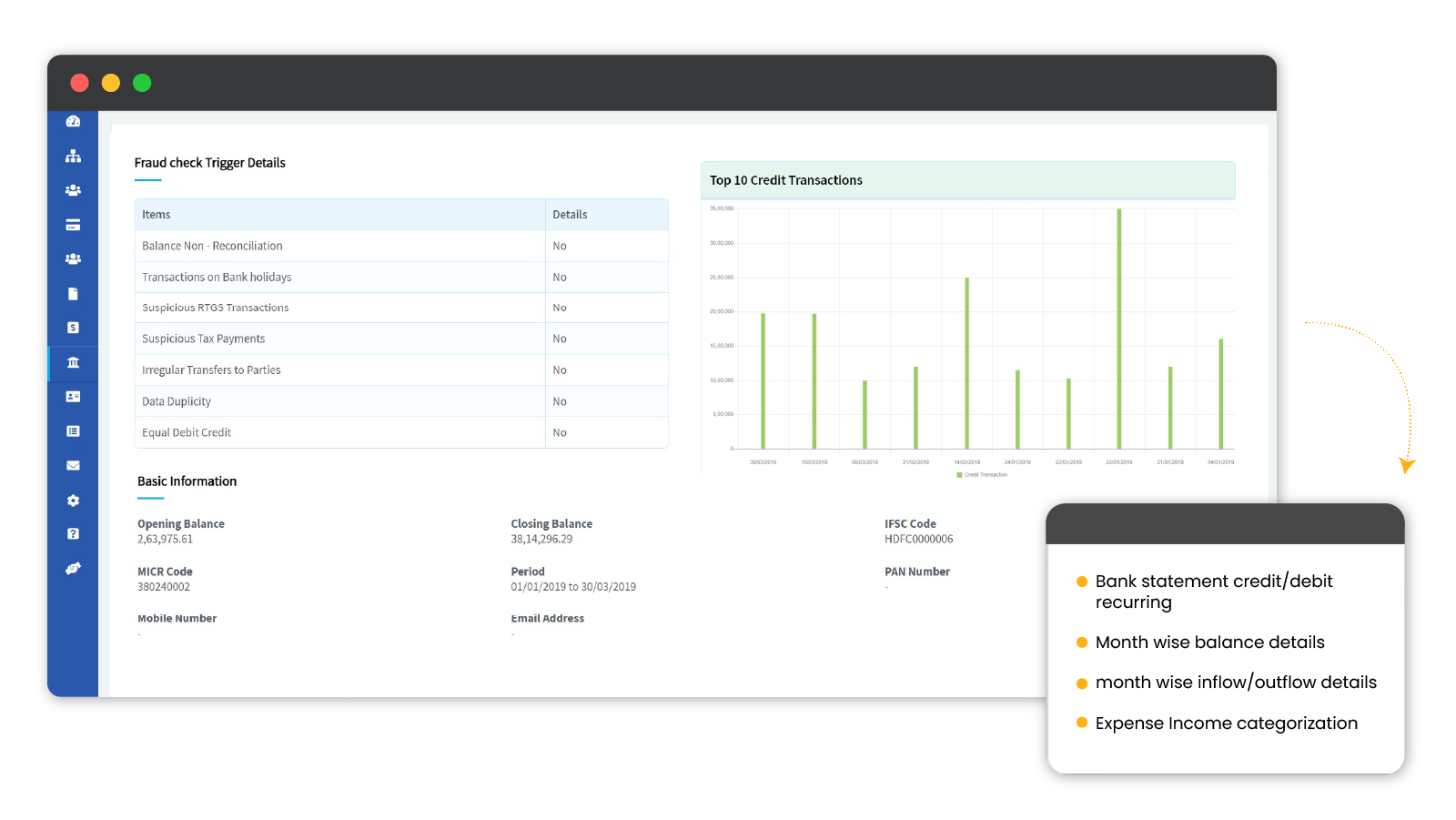

Discover Bank Statement Analyser

Our bank statement analyser generates a consolidated analytical report by merging multiple statements to derive financial insights from multiple bank accounts with IDP/AI -OCR-based data extraction capabilities.

Bridge the gap, Physical to Digital

Process bank statements in any format, including digital and scanned bank statements, or AA JSON, or direct integration with core banking (TXT, JSON, HTML, e-PDF).

Generate customized output reports

Tailored reports enhancing flexibility and meeting reporting metrics efficiently.

Reduce overall TAT and processing time up to 98% with automation

Implement automation to significantly decrease turnaround time (TAT) and processing durations, streamlining operations and improving efficiency by as much as 98%.

Minimize data discrepancies in final reports

Mitigate errors and inconsistencies in final reports with bank statement analyzer, ensuring reliability while minimizing the need for manual intervention and verification.

One-stop Solution

Make better and accurate decisions with Bank Statement Analysis software

Explore endless possibilities with Bank Statement Analysis

Credit Assessment

Evaluate the creditworthiness of individuals or businesses by analyzing their banking transactions, providing insights into financial behavior and repayment capacity.

Credit Risk Monitoring

Continuously monitor and assess risks associated with accounts by analyzing transaction patterns and identifying potential red flags.

Insurance Underwriting

Assess risk levels for insurance policies with bank statement analysis, enabling insurers to make informed underwriting decisions.

Expense Analysis

Gain insights into spending patterns and financial habits by analyzing bank statements, facilitating budgeting, expense tracking.

Investment Decisioning

Evaluate risk factors with bank statement analyzer and enable informed investment decisions.

Experience the game-changer in BFSI: Cygnet Finalyze