Explore the Unmatched Benefits of GST Compliance

A unified portal for all your compliance needs

Ensure integration with various ERPs for seamless transfer of data

Predictive analytics for risk identification and planning

Manage voluminous data in bulk for GST return filing at maximum speed

Maximize input tax credit claims with AI-powered reconciliation

Unlock business compliance insight with Cygnet Tax’s Intelligent dashboards

Value created by Cygnet

business continuity with ITC insight and CFO dashboards

successful ERP integration

accurate ITC claim with AI-based reconciliations

worth of ITC saved every month

month to streamline Accounts Payable

support and expert advice

Trusted by many Clients

What’s in store?

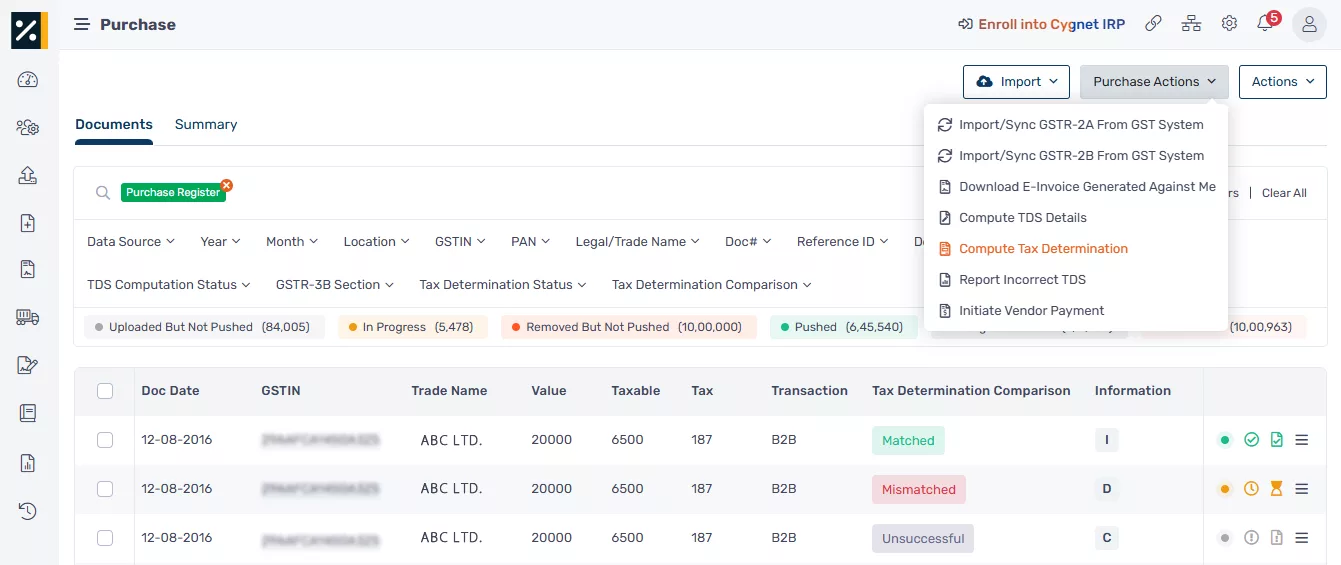

Tax Determination

Ensure accurate classification, rate application, and jurisdictional mapping before your first invoice is even generated.

All-in-One GST Return Filing Tool

Manage all GSTR 1, 2A/2B, 3B, 6A/6B, and annual (9/9C) return preparation and filing to ensure timely compliance and reporting with our GST return filing tool.

Advanced Reconciliation

Leverage AI-ML-driven GSTR-2B and vendor invoices reconciliation tool to optimize input tax credit availment. Ensure upto 99% compliance and informed decision-making by identifying and rectifying errors

GL Reconciliation

Prepare a 6-way reconciliation of General ledger data, sales, purchases, and various GST returns and forms to be audit-ready. Be prepared for annual return filing beforehand to avoid last-minute data discrepancies.

Notice Management

Explore the efficiency of our notice management module, which seamlessly retrieves notices from the GSTN portal, generates timely responses, and provides error-free handling with proactive alerts. It features auto-draft notice replies and AI-based issue identification according to tax laws within our notice compliance management software.

Unlock Input Tax Credit Claims

Mitigate input tax credit blockages by ensuring vendor GST compliance with our solution, featuring automated alerts to drive vendor adherence. Gain insights through GRC scores and dashboards for informed vendor decisions

Accounts Payable

Optimize your working capital efficiency by auto-withholding the vendor’s payment for their GST non-compliance with Cygnet’s Account payable automation

Invoice Management System (IMS)

Automate and streamline invoice processing with real-time validation, reducing manual errors and ensuring compliance with GST regulations.

Input Service Distributor (ISD)

Efficiently manage and distribute input tax credits across multiple branches, ensuring accurate allocation and compliance.

Insightful CFO Reports

Access comprehensive reports and analytics tailored for CFOs, providing deep insights into tax liabilities, compliance status, and financial planning.

Cygnet is changing the Compliance landscape in India

Discover why Cygnet Tax stands out, offering unparalleled benefits

-

Easy integration with ERP and accounting software for seamless extraction of required data

-

Efficiently handle large datasets by automating the retrieval of necessary indirect tax data

-

ITC management by intelligently reconciling vendor’s invoice with GSTR-2B

-

Ensure timely GST return filing with automated tool to avoid unnecessary fees and penalties