Key Milestones & Implementation Timeline

Q4 2024

Development Service Providers’ certification requirements and procedures.

Q2 2025

Introduction of e-Invoicing legislation.

July 2026

phase 1 – go live reporting for B2B & B2G e-Invoicing

March–April 2025

Dedicated portal for e-Invoicing Service Providers Accreditation in the UAE.

December 2025

Pilot Phase begins for UAE e-Invoicing implementation.

On the Horizon

Potential inclusion of Business-to-Consumer (B2C) transactions.

About UAE e-Invoicing & Why It Matters?

The UAE is transitioning to a digital tax system, requiring businesses to issue, store, and report invoices electronically in a structured format as per FTA regulations. This move enhances transparency, reduces fraud, and ensures seamless tax compliance. Its important to note PDFs, Word documents, and scanned copies are not considered as e-Invoices.

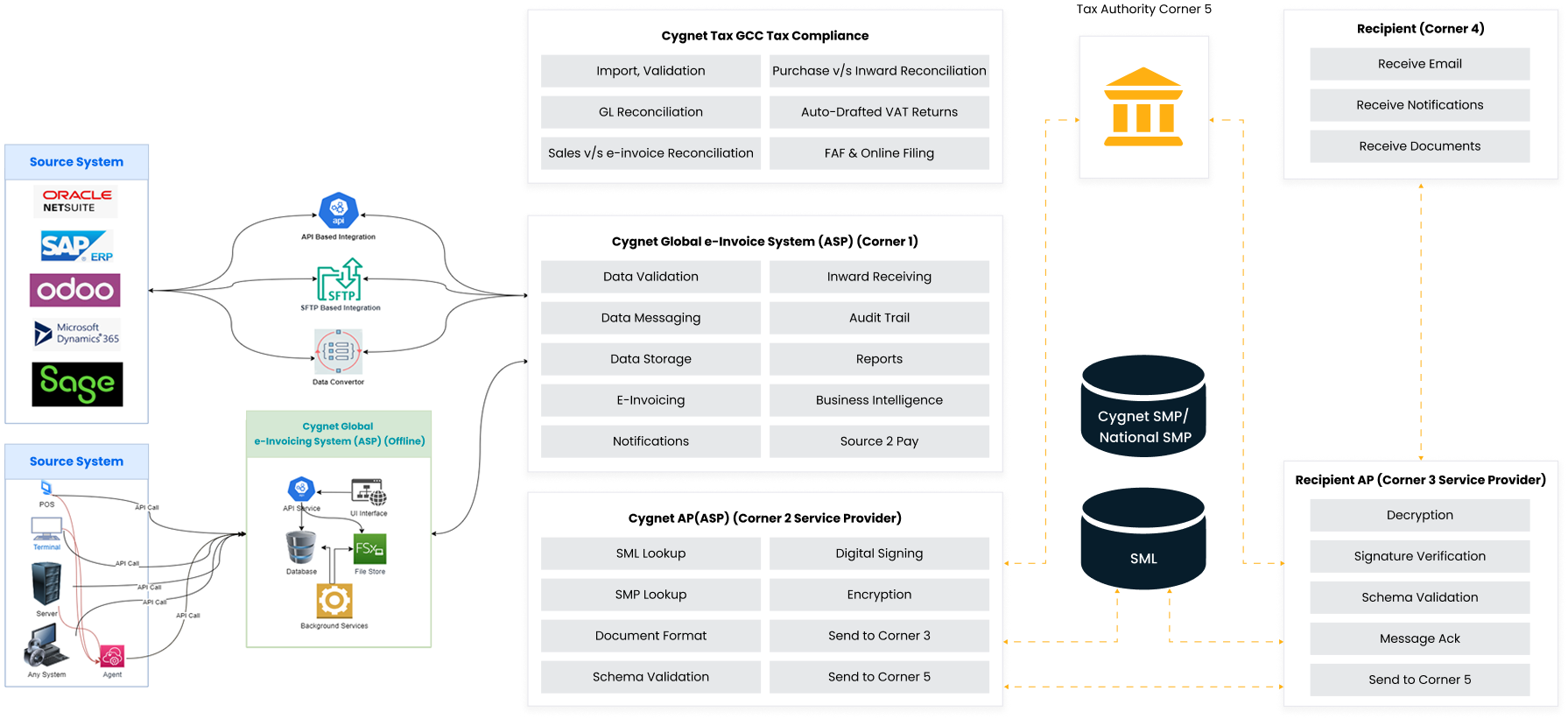

How Does e-Invoicing Work in the UAE?

The United Arab Emirates (UAE) is implementing an e-Invoicing system to enhance tax compliance and streamline financial processes. Here's an overview of how e-Invoicing works in the UAE, incorporating regulations from the Ministry of Finance (MoF) and the Federal Tax Authority (FTA):

Invoice Generation

Businesses generate invoices using their own ERP or billing software, which connects to a UAE-accredited PEPPOL Access Point (AP). This ensures compliance with MoF and FTA regulations.

Real-Time Submission

The invoice is transmitted from the supplier’s AP to the buyer’s AP via the PEPPOL network, using the Service Metadata Publisher to determine the recipient’s AP.

Validation & Approval

The supplier’s AP validates the invoice to ensure compliance with the UAE E-Invoicing Data Dictionary before transmitting it to the buyer’s AP. The buyer’s AP then validates the invoice to ensure all required fields are correct before forwarding it to the buyer’s system. Additionally, the supplier’s AP reports tax-related invoice data to the FTA, ensuring compliance with MoF and VAT regulations.

Acknowledgment & Archiving

- The FTA sends an acknowledgment to the supplier’s AP upon successful reporting.

- The buyer’s AP provides an acknowledgment of receipt to the supplier’s AP.

- Reported e-invoices must be stored electronically for at least five years.

Why Choose Cygnet.One for UAE e-Invoicing?

- Comprehensive Compliance: Our Peppol-certified e-invoicing solution ensures full compliance with UAE FTA regulations.

- Seamless PEPPOL Integration: Secure and standardized invoice exchange within UAE and Globally.

- User-Friendly Platform: Automates and simplifies invoicing, reducing manual errors and ensuring compliance with Peppol BIS 3.0.

- Real-Time Invoice Tracking: Seamlessly connects with SAP, Oracle, Microsoft Dynamics, QuickBooks, Zoho, and other ERP/accounting systems

- Effortless Integration : Easily connects with your existing ERP/accounting software.

- Seamless e-Invoicing & VAT Compliance: Our solution supports e-invoicing and VAT compliance, ensuring structured tax reporting and streamlined reconciliation of VAT and invoices

Challenges & How We Solve Them

Common e-Invoicing Challenges

- Manual errors & compliance risks

- Data inconsistency & integration issues

- Lack of real-time tracking & validation

- Data security & privacy concerns

- Archiving & audit compliance complexities

Cygnet.One’s Solution

- Automated tax compliance Eliminates manual errors & ensures regulatory adherence

- End-to-end integration Seamless connectivity with existing ERP, legacy & accounting systems

- Real-time tracking & reporting Ensures accuracy & transparency

- Robust data security & privacy Encrypted storage & secured data handling

- Archiving & audit compliance Minimum 5 years of legally compliant data retention