About VAT automation & compliance

Smarter & faster compliance management, way better efficiency!

Corporations and accounting firms operating in the UK, Europe, and further afield are required to navigate a dynamic indirect tax regulatory landscape. Businesses incur significant costs managing VAT return compliance processes and data validation. Our TaxTech Indirect Tax Compliance Platform helps all sizes of businesses to achieve compliance by providing a centralized, scalable, and automated solution to accurately prepare and file VAT returns in the UK, EU, and further afield.

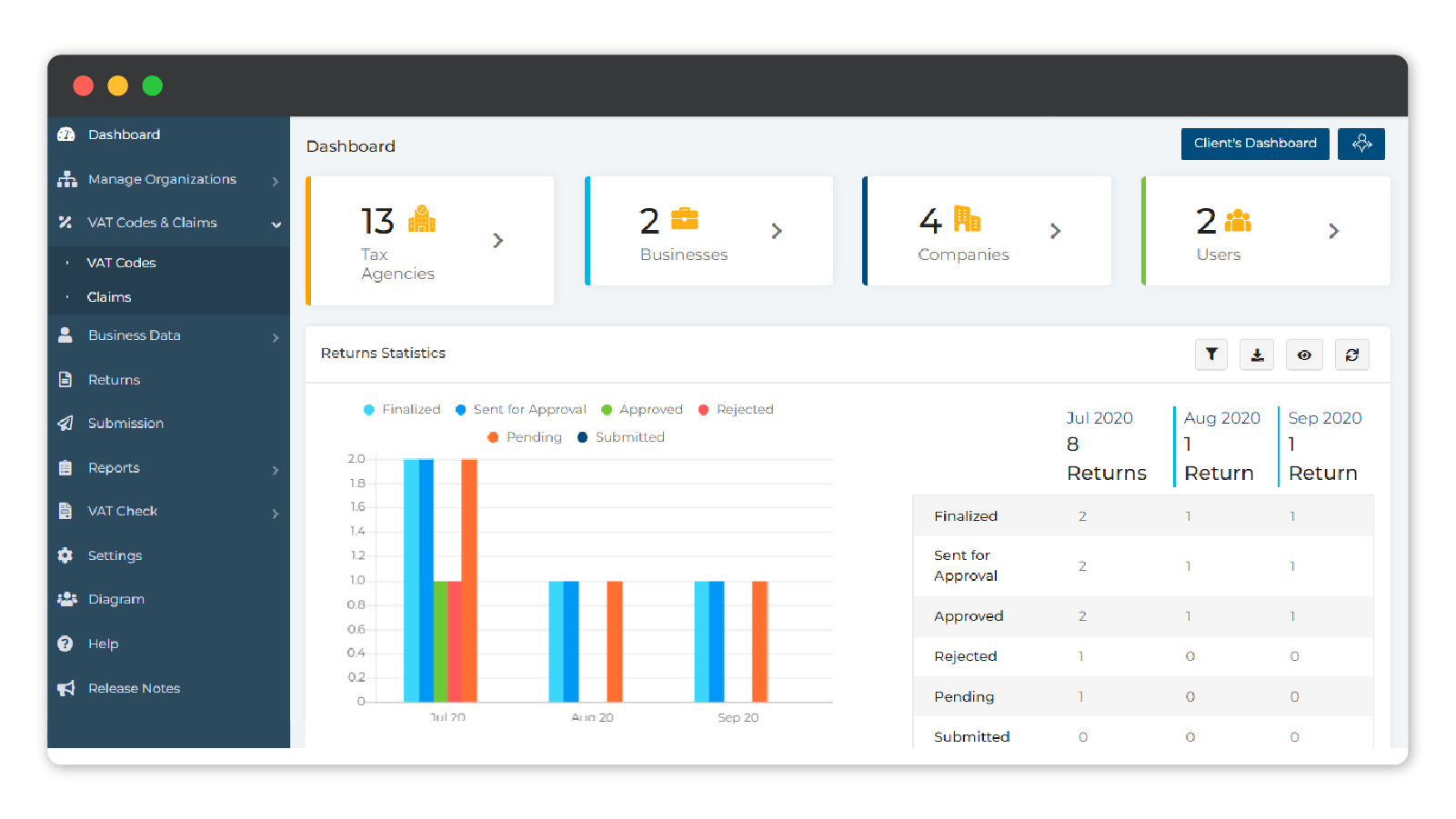

An easy-to-use cloud application for all sizes of organizations to meet their VAT return filing obligations

A comprehensive end-to-end solution encompassing many features

Robust multi-country SAAS VAT compliance solution

Seamless integration with multiple source systems

Easy to use and intuitive user interface

Compatible with any size of business in any industry

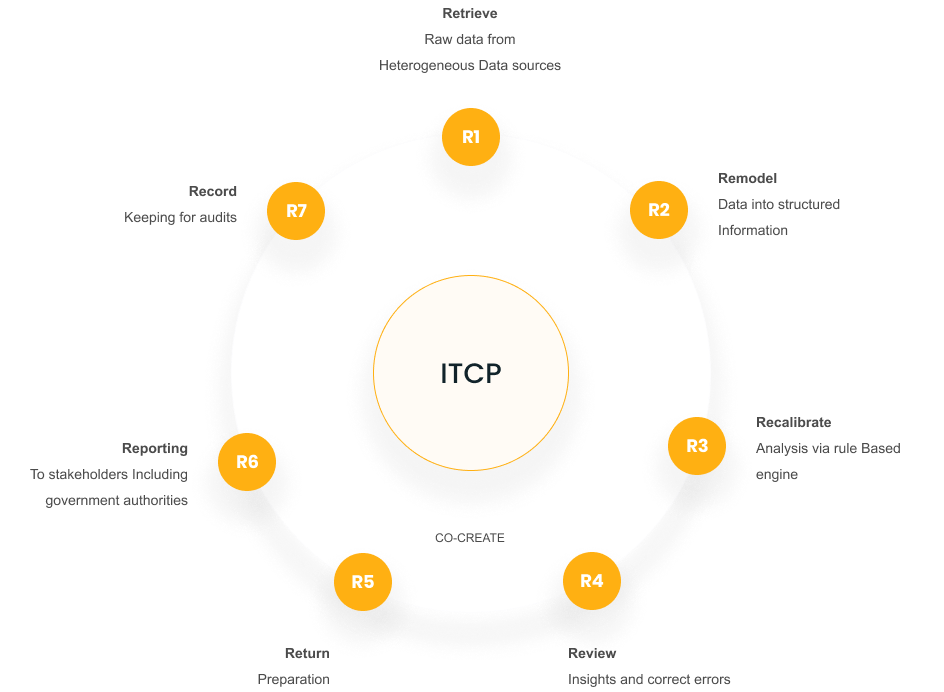

Cygnet One's Indirect Tax Software Solution

is built and supported by our expert tax professionals

The software is updated regularly for tax and system logic ensuring full compliance with current legislation and delivering a comprehensive automated cloud-based solution that is fast, accurate, and easy to use.

Highlights of Indirect Tax Compliance platform

Modern challenges require modern solutions

Here’s how the VAT return solution will help to automate your tax processes

Improve data accuracy

Extract, clean, merge and use data from multiple source business systems, i.e., POS, ERPs, CMS, accounting systems, and others at transactional, summary, and line levels using SFTT/FTP, SSIS, API connectors, and more.

Multi-country VAT return software

Centralize all your entity’s VAT reporting, data collection, return preparation, and filing across multiple jurisdictions on a single platform.

Intuitive data insights

The dashboard presents an in-depth view of statistics & insights related to VAT data and filing deadlines.

Efficient risks management

Detailed audit trail to ensure good governance and control of VAT management and processes.

Digital filing and submissions

From generating invoices to filing returns, link your system directly to tax authorities such as HMRC & others.

Achieve improved security

Keep the data secured with VAPT, ISO 9001, ISO 27001, CMMI-3 certification and more