About Accounts Payable automation

Smarter & faster compliance management, way better efficiency!

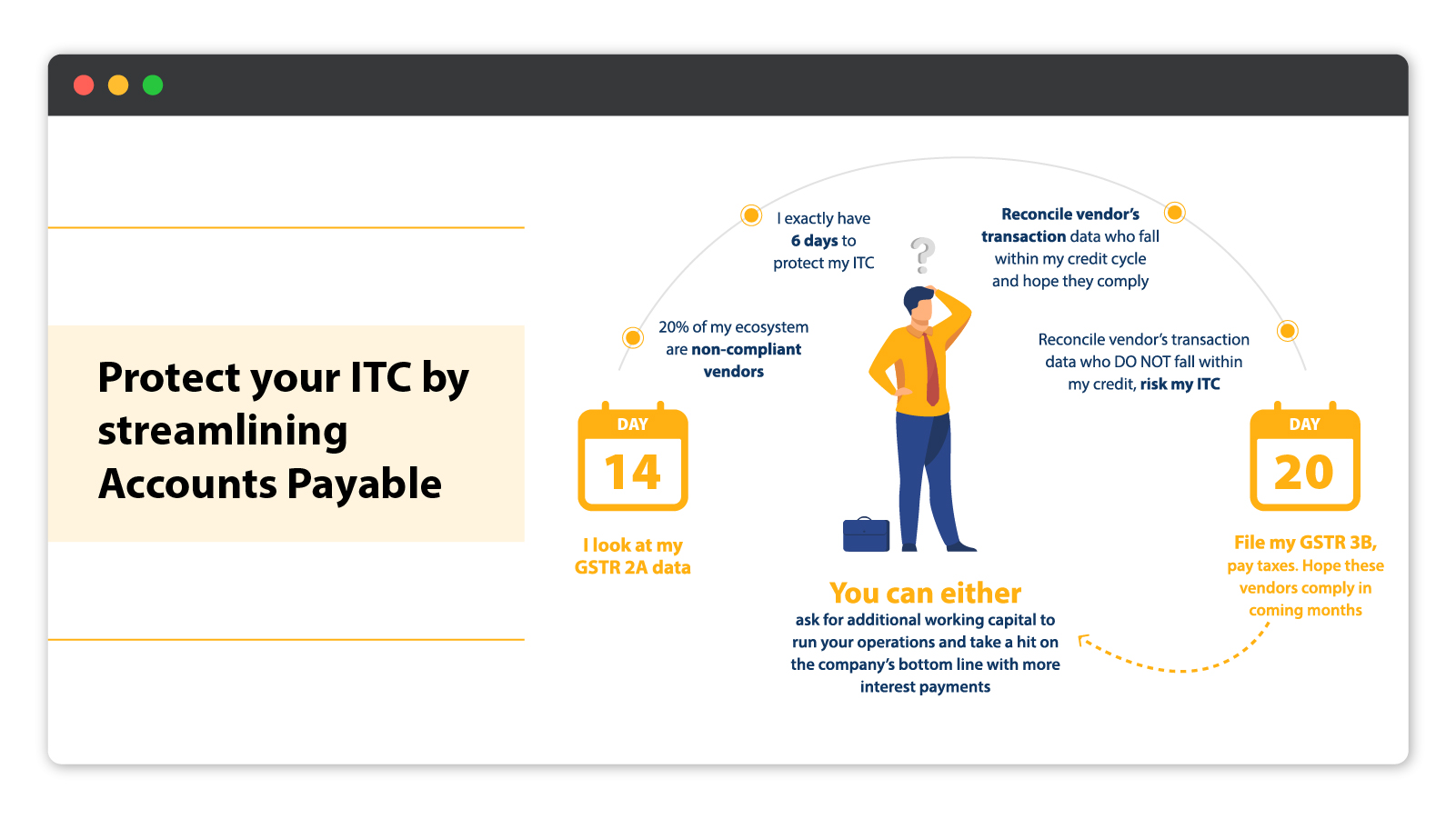

The AP automation is intended to perform real-time reconciliation checks for the documents at the time of recording and thereafter to withhold the payments on invoice/tax value to the non-compliant vendors, or raise a debit note if the payment has been made.

Secure your business' cash flow through streamlined payments with accounts payable automation

Seamless Integration

Integrate with multiple systems and ERPs for smoothly transferring data to Cygnet’s e-Invoicing software

- SAP

- Oracle

- Tally

- Microsoft Dynamics

- custom ERPs

Process invoices with Intelligent Document Processing

- AI/ML trained model to extract invoice information, check data integrity & authenticity to conduct multiple data checks for improved data quality

Enable payment decisions basis reconciliation

- For matched invoices, payment block is released

- For mismatch invoice, payment block is applied for entire invoice

- For partial match, regards to tolerance limit set by entity, GST amount shall be blocked

Enable payment decisions basis business exigencies

- For a mismatch invoice, only block tax amount as an exemption as per business exigencies

- If any payment terms, clear payment based on their GRC score (compliance rating).

- If the invoices are not reported subsequently, debit note shall be auto generated

Generate payment reports

- Generate ERP reports depicting payment blocking status basis Reconciliation

- Create comprehensive reports for just-in-time analysis for the accounts payable team

Experience the Power of Compliance based Automated Payments

Unlock 50% efficiency in your accounts payable process

-

Easy integration with ERP and accounting software for seamless extraction of required data

-

Efficiently handle large datasets by automating the retrieval of necessary return data

-

ITC management by intelligently reconciling vendor’s invoice with GSTR-2B

-

Ensure timely filing of returns to avoid unnecessary fees and penalties