Here’s why we are your best choice!

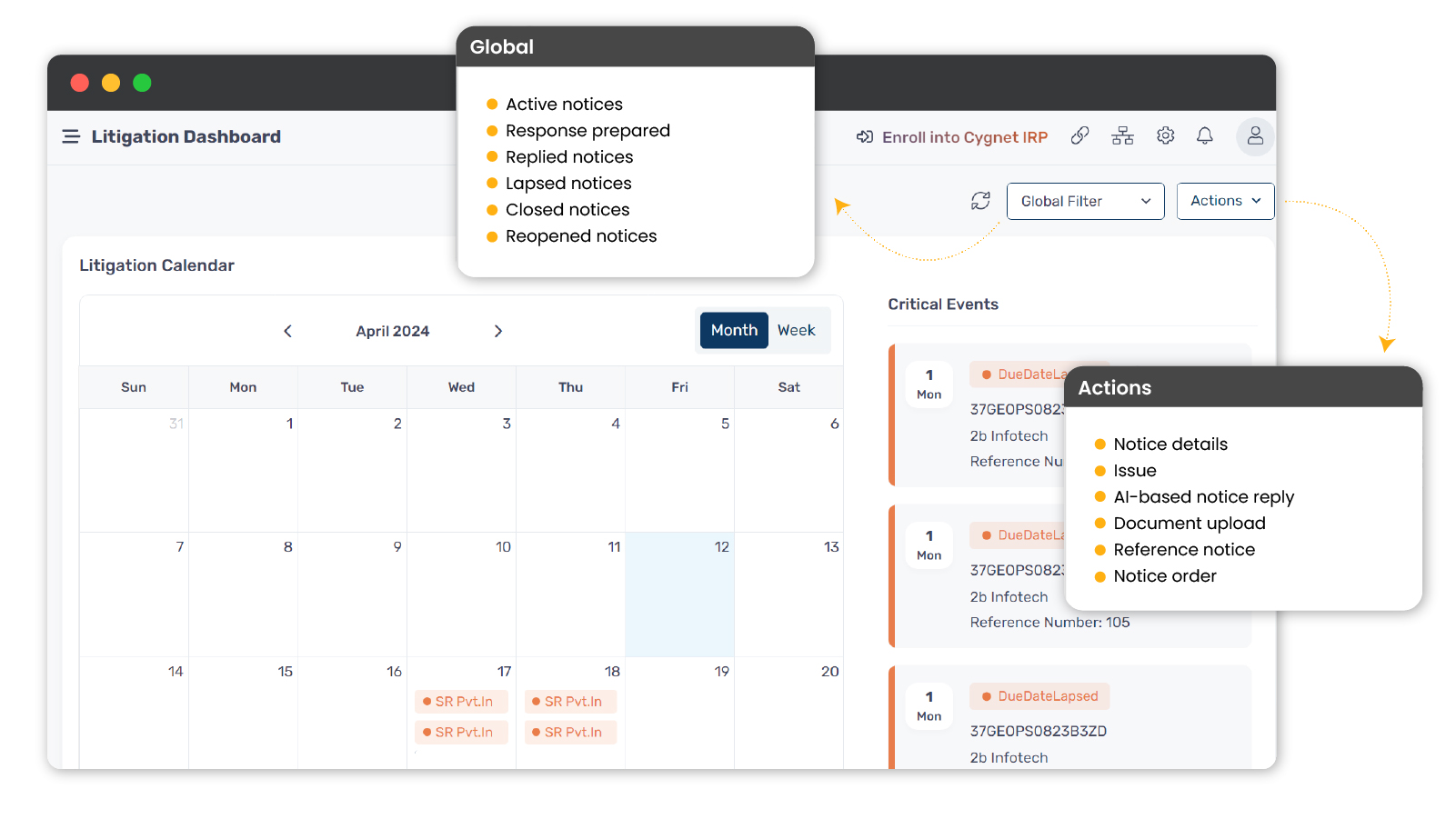

Get centralized notices from emails and GSTN Portal

AI/ML assists in drafting notices, finding pertinent court Judgements, and offering legal defence guidance

Court hearing calendar and timely alerts for notice response deadlines

Easy tracking and real-time updates of the notice status

Secured roll-based data access management

Insights and dashboards with user preference and filter for the tax head

Transform your tax operations with our business first platforms

Turn legal headaches into wins with Cygnet's litigation system

-

Risk mitigation for untimely notice replies due to employee turnover

-

Seamless communication with our legal experts and consultants

-

Reduced cost with no penalties or fees

-

Time-saving due to the availability of non-scattered data

-

Reduced human errors and omissions of critical points when preparing notices

Unlock Business Potential with Cygnet's Comprehensive Solutions SuitTop of Forme

Be compliance-ready with Cygnets’

GST Compliance Suits

Facilitating advanced reconciliation to minimize litigation and Integrate litigation management system to extract necessary data for notice replies effortlessly.

Managed Services

Tax experts/Consultants offer legal advice and assistance in preparing replies and documents.

Value created by Cygnet

100%

business continuity with ITC insight and CFO dashboards

250+

successful ERP integration

90%

faster process cycle

24x7

support and expert advice