Discover Cygnet Finalyze

An analytical engine for diverse data sources such as GST, ITR, bank statements, financial statements, bureau data, etc., to derive insightful data for assessing borrower creditworthiness and spotting potential risks.

Plug-and-play control with APIs

Seamless integration and control with API-driven platform modules, enabling easy connectivity with other systems.

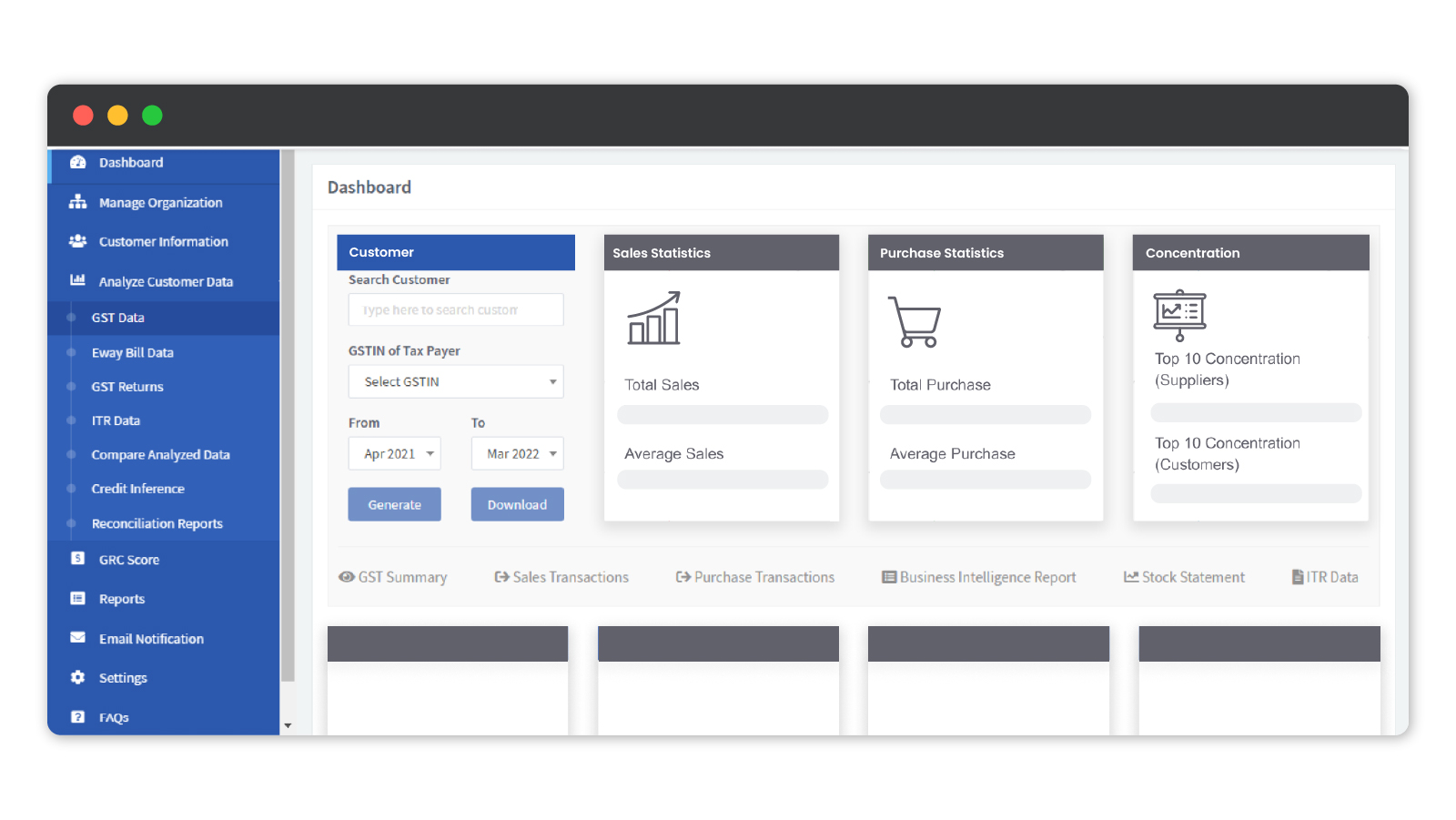

Multiple modules meeting your custom needs

The platform encompasses a variety of modules tailored to meet specific requirements, providing flexibility and customization options.

Enable data-driven approach with IDP/ AA/core-banking integration mechanism

Integrate with core-banking tech, or Intelligent Document Processing or Account Aggregator ecosystem for seamless operational execution.

Insights to help navigate risk-free decisioning

Cygnet Finalyze provides detailed insights with analytical reports to support informed decision-making, minimizing risks.

Experience the game-changer in BFSI: Cygnet Finalyze

Navigate the data landscape with the new-age analytical engine!

Explore endless possibilities with Cygnet Finalyze

Credit assessment

Evaluate individuals or businesses’ creditworthiness to determine loan eligibility with Cygnet Finalyze for data-driven analysis.

Insurance underwriting

Assess risks associated with insuring individuals or entities to determine coverage terms.

Credit Risk Monitoring

Continuously observe and analyse potential risks with Cygnet Finalyze data-driven analysis to ensure proactive risk management.

Spot Business Risks

Mitigate the risks associated with the business by analyzing data-driven dashboards and summarizing all the sales and purchase insights along with vendor ecosystem evaluation.