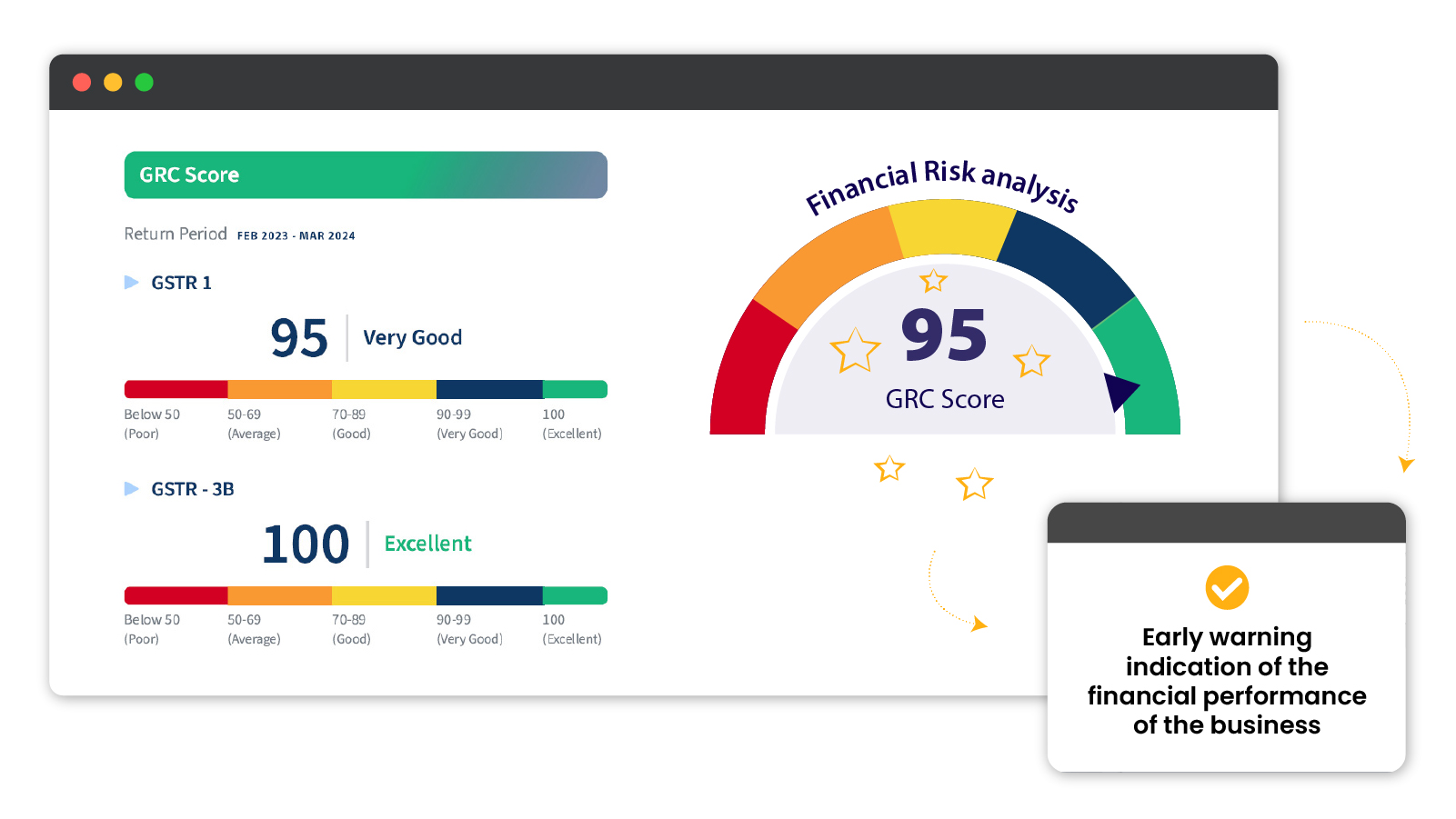

Discover GRC Score

GST Return Compliance (GRC) Score is built on return filing trends of GST-registered entities and calculated leveraging publicly available GST data.

Pre-qualify loan leads

Assess potential borrowers’ eligibility and creditworthiness as a prescreening procedure, improving efficiency and conversion rates.

Spot potential NPAs with GRC score

Evaluate lending risk using GST Return Compliance score, identifying loans at risk of default to mitigate potential losses proactively.

Reduce the TAT and cost of assessing loan applications

Streamline loan application processing leveraging technology for swift, accurate decisions with GRC score, enhancing operational efficiency.

Assess newly onboarded customers to protect InputTax Credit (ITC)

Evaluate new customers to safeguard against potential losses related to goods and services tax (GST) compliance issues, ensuring eligibility for Input Tax Credit.

A low GRC score correlates with the probability of financial default in the near future.

Explore endless possibilities with GRC score

Loan Approval

Check filing trends of GST registered business entity as pre-screening procedure to their loan application.

Credit Risk Monitoring

Through continuous monitoring, GRC scoring enables lenders to track the performance of existing loans, identifying any potential signs of financial distress.

Early warning signals

GRC scoring generates early warning signals by detecting deviations in one’s GST filing trends and alerting stakeholders with risk potential.

Vendor or customer assessment

Organizations use the GRC score to evaluate the risk posed by vendors or customers, enabling them to make informed decisions about partnerships, transactions, and credit extensions.

Experience the game-changer in BFSI : Cygnet Finalyze